Wondering, how does the Swiss pension system work? This guide offers a comprehensive look at the Swiss pension system explained — a must-read for U.S. expats planning a long-term move to Switzerland.

For U.S. expat employees, understanding how the Swiss retirement system interacts with U.S. retirement planning is essential to protect your financial future.

This article kicks off a three-part series breaking down the Swiss pension Pillar 1, Pillar 2, and Pillar 3 systems.

Last updated in July 2025.

The Swiss Pension System: Pillar 1

The “3 pillar system in Switzerland” refers to the three parts of the Switzerland pension system. While most parts have natural parallels with the U.S. system, it’s important to carefully review the nuances of each pillar to avoid unwelcome surprises from the IRS.

Diving in: What Is Pillar 1 in the Swiss Pension System?

Pillar 1 in Switzerland is the mandatory state pension provision, comparable to U.S. Social Security.

Pillar 1 ensures a basic level of income in retirement and consists of:

Old-Age and Survivors’ Insurance (OASI / AHV / AVS pension)

Provides retirement and survivors’ benefits for insured individuals and their families.

Disability Insurance (IV/DI)

Supports eligible individuals unable to work due to health reasons, often allowing part-time employment alongside benefits.

Supplementary Benefits (EL)

Funded by taxes to cover maternity leave, military pay, or when pensions don’t meet minimum living costs.

Contributing to the Swiss State Pension System

Contributions to Pillar 1 Pension in Switzerland (2025 Update)

As of January 1, 2025, the contribution rates for Switzerland’s Old Age and Survivors’ Insurance (OASI/AHV/AVS) remain unchanged.

For employed individuals, the total contribution is 10.6% of gross salary, shared equally between the employee and employer (5.3% each). (1) This covers OASI, Disability Insurance (DI), and Income Compensation (EO).

Contributions for Self-Employed and Non-Employed Individuals

Self-employed individuals pay a total rate of 10.0% if their annual income is CHF 60,500 or more. For lower incomes, a degressive scale applies, resulting in reduced contribution rates.

Non-employed individuals (including retirees not yet drawing benefits) are required to pay a minimum annual contribution of CHF 530.

Calculating Your Distributions

There are various online tools available to assist you in calculating your retirement distributions.

Switzerland’s AHV/AVS Online Pension Calculator

This online calculator will provide a good estimate. If you have worked at least one full year in Switzerland and otherwise qualify, you will not receive a reduction in distributions. You can find the AHV/AVS calculator in the references section at the end of this article.

Comparing Switzerland vs the U.S.

Key Differences from U.S. Social Security

In the U.S., Social Security contributions are capped at $176,100 in wages (2025). (2)

In Switzerland, the Swiss retirement system applies OASI contributions to all earned income, i.e., there is no wage cap.

However, certain income types, such as Swiss family allowances, are excluded from this calculation. (3)

Mandatory Swiss pillar 1 contributions start from January 1 of the year you turn 18 (if employed) or 21 (if unemployed) and continue until you reach the official reference age (formerly known as “retirement age”).

U.S. Tax Considerations

If you’re preparing to withdraw Pillar 1 Switzerland benefits, it’s crucial to understand how these interact with U.S. tax obligations. Under the Swiss Pillar 1 and U.S. tax rules, cross-border tax planning helps ensure you avoid double taxation and optimize your retirement benefits.

Note: Errors in understanding can be costly and, understandably, frustrating if you realize in hindsight they were avoidable, which is why we’re breaking down the most important topics.

If you have a few quick questions but don’t need or want comprehensive financial planning, consider scheduling an expat coaching call to get clear on your path forward as a U.S. expat in Switzerland.

Retirement Age

Switzerland: Under the 2024 pension reform, the retirement age is now set at 65 for both men and women. There are transitional provisions for women born between 1961 and 1969.

In Switzerland, you have the option to receive early distributions up to two years before retirement or defer them for up to five years.

Through receiving early distributions, your future benefits will be permanently reduced, while deferring will result in a higher benefit in future years.

Whether you wish to start receiving distributions early, at full retirement age, or intend to defer retirement, you must apply to do so.

United States: The U.S. full retirement age has been slowly increasing over the years and currently stands at 67 for both men and women.

You have the option to receive early distributions starting at age 62 or defer until age 67. The same rules apply, as early distributions permanently reduce future benefits, and deferring results in a higher future benefit.

It is important to note that if you plan on retiring in the U.S., you must work there for at least 10 years to be eligible for U.S. Medicare. Otherwise, you must plan to purchase additional health insurance coverage.

Breaking Down the Swiss Pension Reform

In January 2024, Switzerland introduced a major Swiss pension reform. The term “normal retirement age” was replaced with “reference age,” reflecting flexible retirement timelines.

The Swiss retirement age is now set at 65 for both men and women, with special provisions for women born between 1961 and 1969. You can claim full Swiss retirement benefits two years early (with reduced payouts) or defer up to five years (for enhanced payouts).

Taxation and Cross-Border Considerations

Swiss Pension and Retirement Taxation

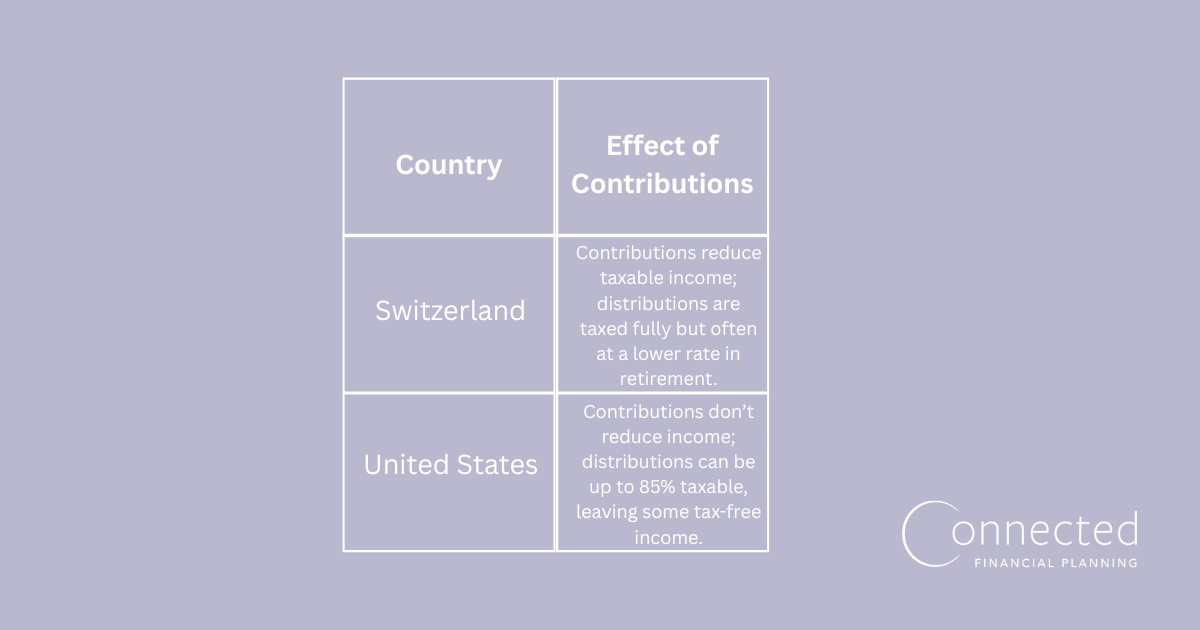

A key difference between Switzerland and the U.S. is how contributions and distributions are taxed:

If you’re asking, “Is my Swiss pension taxable in the U.S.?” — the answer is yes, under specific reporting rules. Coordination between the U.S. and Swiss tax systems is critical, particularly for Americans planning to live long-term or retire in Switzerland.

Early Retirement and Distributions

If you’re planning to leave Switzerland, understanding Pillar 1 leaving Switzerland is essential. While U.S. Social Security requires 40 quarters of contributions (10 working years), Swiss pensions are calculated based on a full 44-year contribution period.

The average Swiss pension ranges from CHF 1,225 to CHF 2,450 per month, with married couples capped at 150% of the maximum.

For those curious about how to claim a Swiss pension, online tools like the AHV/AVS pension calculator can help estimate benefits, while working with a cross-border professional can ensure you’re maximizing the financial impact of your distributions.

Early retirement protocol

Switzerland: Since the OASI 21 reform went into effect on 1 January 2024, Switzerland now offers a more flexible withdrawal of benefits during retirement:

- You can draw full OASI pension benefits as early as two years before the age of 65.

- Independent of whether you retire early or at 65, you can draw a portion of your retirement (between 20% and 80%).

- If you choose to retire more than two years before reaching full retirement age, you will still be required to make AHV/AVS contributions while not employed. The exact amount you need to contribute is uniquely calculated based on your net worth and other income sources.

United States: The minimum contribution period in the U.S. to qualify for distributions is 40 quarters (or 10 years). If you stop working, you are not required to continue making contributions, but your benefits will be reduced when you retire.

Digging into distributions

Switzerland: At present, the minimum Swiss social security annuity is typically CHF 1,260 per month, and the maximum is CHF 2,520 per month. For married couples, the maximum benefit is no more than 150% of the maximum pension.

These distribution amounts are based on “complete contributions.” The term “complete contributions” means that you made contributions for the entire contribution period (44 years).

For each missed year, there will be a reduction in the distribution.

United States: The maximum amount of Social Security distributions an individual can receive varies depending on when you retire:

On average, however, a U.S. retiree in 2025 will receive just under $2,000 per month. (4)

Note: A married couple who both meet the requirements for a maximum distribution does not receive a reduction in the amount received.

U.S.-Swiss Social Security Totalization Treaty

The U.S. and Switzerland have a totalization treaty in place, which is intended to protect individuals who work between the two countries. (5) It allows you (and your employer) to avoid mandatory contributions to both pension systems.

Unfortunately, the scope of the treaty does not include U.S. Medicare coverage, making certain expats in Switzerland liable for Medicare contributions.

Note: Whether you’re drawing a Swiss AHV pension or managing Swiss AVS pension assets, cross-border financial planning is key.

Has the Windfall Elimination Provision been repealed?

Yes! The Windfall Elimination Provision was officially repealed in January 2025.

U.S. Social Security Administration (SSA)

If you are in the U.S. or have a valid U.S. address, you can create an ID.me account to view your U.S. Social Security Statement.

This statement is helpful for those looking to learn about their future Social Security benefits and earnings history.

"Request for Social Security Statement"

If you are living abroad and do not have a U.S. address, you will need to submit Form SSA-7004 ("Request for Social Security Statement") to receive your Social Security Statement.

Final Considerations

Spending your career working in both the U.S. and Switzerland can be extremely rewarding, but it requires careful planning when it comes to retirement.

Due to the differing contribution periods, variation in individuals’ careers, and the U.S.-Switzerland Totalization Treaty, there are numerous factors to consider when calculating your expected benefits.

We recommend consulting both a cross-border financial planner and a tax advisor to make sure you’re effectively tax planning e.g., anticipating things such as the Net Investment Income Tax and avoiding PFIC traps.

It’s also important to understand how to claim your Swiss pension in the most tax-efficient manner and ensure smooth integration of U.S. and Swiss retirement assets.

You can read more about the Swiss Pillars in our articles about Swiss Pillar 2 and Swiss Pillar 3.

Resources

- OASI contributions

- Contribution and Benefit Base – SSA

- Family Allowance in Switzerland

- What the Data Says About Social Security – Pew Research Center

- Totalization Agreement with Switzerland

- AXA - Pillar 1

References

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with US expats on US tax and financial planning issues. She is passionate about working with US expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the US, Germany, and Switzerland.