The Net Investment Income Tax (NIIT) is a by-product of the 2010 Health Care and Education Act, which resulted in substantial US tax law changes. (These also affect US expats.) These changes went into effect on January 1, 2013, and implicate high-earning US taxpayers.

Imposed by section 1411 of the Internal Revenue Code (IRC), the 3.8% Net Investment Income Tax applies to individuals, estates, and trusts when income is above the statutory threshold amounts, minus related expenses.

The 3.8% 2025 NIIT rate remains the same as 2024.

In this article, we define the types of income that qualify as net investment income (NII) and break out the qualifying income thresholds based on filing status.

We also present a high-level overview of strategies that may be used to mitigate NIIT and answer a few common questions.

Let’s dig in.

Defining net investment income (NII)

Before we get to a NIIT definition, let’s first define net investment income.

Net investment income is passive income received from assets (before taxes) as defined under IRS section 469. (1)

The net investment income tax is triggered when your modified adjusted gross income (MAGI) exceeds the statutory threshold. (2) At that point, either your total net investment income or part of your MAGI is subject to the 3.8% tax surcharge.

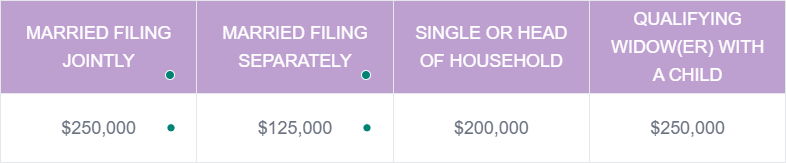

Statutory Threshold Amounts (NIIT 2025)

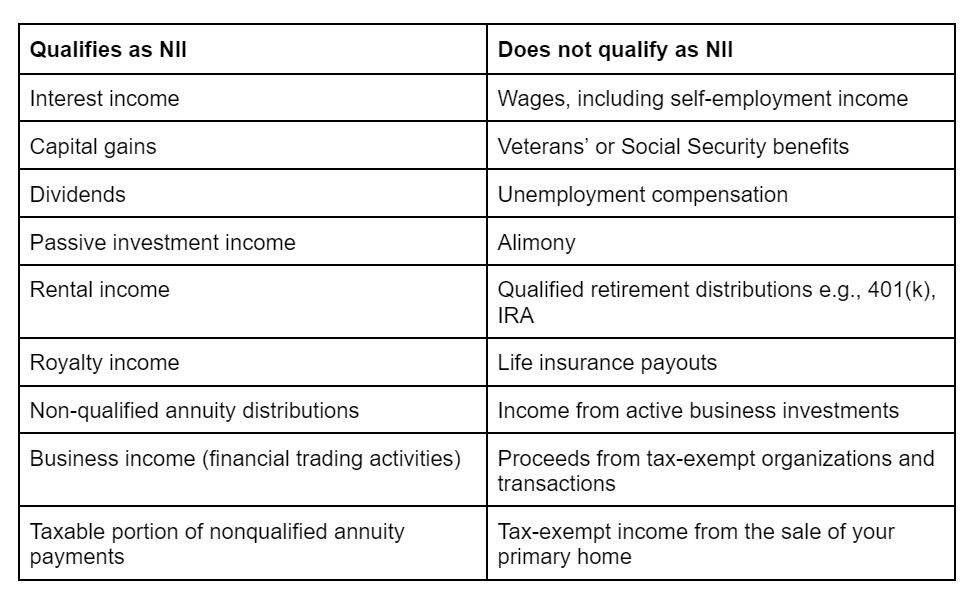

The table below notes different types of income and whether they count toward the NIIT threshold.

Net Investment Income (NII) Tax 2025: How to Calculate What You Owe

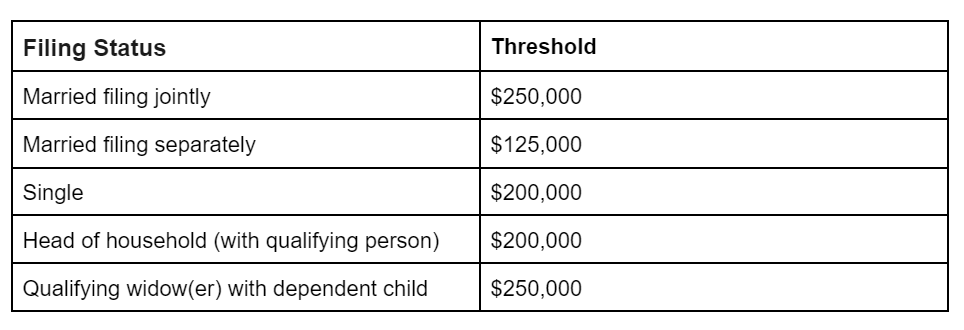

As we’ve mentioned, the 2025 net investment income tax remains 3.8%. Your filing status determines the income threshold that triggers the tax.

However, you’re only subject to the 3.8% NIIT if you have net investment income and your MAGI exceeds these thresholds. When calculating your MAGI, the amount is typically identical to your Adjusted Gross Income (AGI).

Important callout: If both your NII and MAGI exceed the threshold associated with your filing status, the NIIT is applied to the income type with the lowest overage.

Where MAGI is the higher of the two, the 3.8% tax is applied on the excess of modified adjusted gross income (more on this later).

Below is a table summarizing the NIIT as it applies to individuals. (3)

These threshold amounts are not indexed for inflation, meaning that they remain the same from one tax year to the next.

Reporting Net Investment Income Tax

To determine your NIIT, use IRS Form 8960 to calculate your net investment income tax. (4)

Additionally, individuals owing NIIT must make quarterly estimated payments on the amount they anticipate owing, in addition to any quarterly income payments.

Calculating What You Owe: Two NIIT Examples

Let’s look at two hypothetical scenarios in which you would owe NIIT.

NIIT Example 1: Net Investment Income Overage

Let's say you are a single filer. After calculating your net investment income and corroborating that figure with your financial planner, your total NII is $20,000. Your MAGI exceeds the $200,000 threshold for single filers by $10,000.

You will owe the 3.8% net investment income tax – but only on the $10,000 of NII you have since it's less than your MAGI overage.

Your NIIT due would be $380 (.038 x $10,000).

NIIT Example 2: MAGI Overage

Let's say you are a single filer. After calculating your net investment income and corroborating that figure with your financial planner, your NII total is $100,000. Your MAGI is $250,000, exceeding the $200,000 threshold for single filers by $50,000.

You will owe the 3.8% net investment income tax – but only on the $50,000 of MAGI that is in excess of the $200,000 threshold—since it's less than your NII overage.

Your NIIT due would be $1,900 (.038 x $50,000).

How to Avoid Net Investment Income Tax

Being able to successfully ascertain whether you’ll owe the net investment income tax (and how much) probably doesn’t feel like a win if the bottom line is that you owe.

So, it’s natural to look for ways to avoid NIIT – or at least reduce it. The extent to which you can reduce your NII tax liability depends on your ability to reduce your reported MAGI or NII.

This is where being proactive pays dividends in the long run.

After you determine that you have taxable financial accounts and other qualifying investments subject to NIIT, you should review your financial plan and tax strategy to eliminate or reduce your tax exposure.

Reducing Your Reported MAGI

There are a variety of strategies that US taxpayers can (and do) take to reduce their reported MAGI. But, every situation is unique, particularly where US expats are concerned. This is because many strategies that are available to Americans living in the US become inaccessible or encounter complicating factors when residing outside the US.

A few common ways that you might achieve a reduction in MAGI reporting include:

- Contributing to qualified retirement plans

- Donating to charities (i.e., charitable giving)

- Tax-loss harvesting

- Reducing income from self-employment

To ensure that your strategy is airtight and maximally efficient year-over-year, it may be worthwhile to work with a cross-border tax professional. Similarly, a certified cross-border financial planner can ensure that your short-term planning aligns with your long-term financial goals.

Reducing Your Net Investment Income

When your NII is higher than your MAGI, it’s beneficial to explore options to reduce that figure.

For example, it may be beneficial to explore opportunities to meet the material participation standard. Doing so could recategorize NII-qualified income to be non-qualified, thus lowering the total amount that is vulnerable to the NIIT.

Meeting the Material Participation Standard

To be treated as a material participant in an activity, an individual must be involved in the activity’s operations on a regular, continuous, and substantial basis. There are seven tests (of which an individual only needs to satisfy one) used to determine whether someone is a material participant. (5)

Note: It is strongly recommended to engage a financial advisor when determining whether material participation or passive participation is the best strategic approach. U.S. expats in particular should seek out cross-border financial advising expertise to ensure they are receiving the most holistic advice.

The Build Back Better Act’s modifications to the net investment income tax

From the official White House Fact Sheet issued in March 2024: “The President’s Budget extends the solvency of the Medicare Hospital Insurance (HI) trust fund indefinitely by modestly increasing the Medicare tax rate on incomes above $400,000, closing loopholes in existing Medicare taxes, and directing revenue from the Net Investment Income Tax into the HI trust fund as was originally intended…” (6)

Additionally, the Build Back Better Act expanded the scope of the net investment income tax to apply to:

- active business income for pass-through firms

- the 3.8% net investment income tax to trade or business income over $400,000, and

- the 3.8% net investment income tax to trade or business income over $400,000 not currently subject to the NIIT. (7)

A Brief Note On The Tax Cuts and Jobs Act (TCJA) of 2017

Many of the changes in the TCJA are set to expire at the end of 2025. (8) However, the 3.8% NIIT is not part of the TCJA and therefore not implicated in any changes on the horizon for that piece of legislation.

FAQs: Net Investment Income Tax (NIIT)

Is rental income subject to net investment income tax?

Another common question on this point is, “Does net investment income tax apply to property?” The answer is yes. Income from rental property is income subject to NIIT in the event of a threshold overage.

Does NIIT apply to the sale of a rental property?

If the sale of a rental property resulted in capital gains, yes, that income is qualified for NIIT.

However, if the sale of the rental property resulted in a loss, that figure could actually be subtracted from your overall net investment income to lower the total.

Are royalties subject to net investment income tax?

Yes. The IRS classifies royalties as subject to net investment income tax in the event of a threshold overage.

What capital gains are excluded from net investment income tax?

In general, capital gains are subject to net investment income tax. However, there is an exception for amounts excluded from your Form 1040 due to the threshold amounts on Form 8814 and (b) amounts attributable to Alaska Permanent Fund Dividends. (9)

Are stock options subject to net investment income tax?

Yes. The IRS classifies stock options as subject to net investment income tax in the event of a threshold overage.

Are IC-DISC dividends subject to net investment income tax?

Yes. IC-DISC dividends are subject to net investment income tax in the event of a threshold overage.

Is S-corp income subject to net investment income tax?

Self-employment income paid out of an S-corp is not subject to the 3.8% net investment income tax, nor does it count toward the threshold. However, there may be other situations where financial distributions from an S-corp contribute to or trigger the net investment income tax, so it’s important to understand how different types of entity distributions are viewed by the IRS. (10)

Are C-corp dividends subject to net investment income tax?

Yes.

Does net investment income apply to the sale of a business?

This is a complex question that depends on a variety of factors, including but not limited to the degree to which the US taxpayer had active participation in the business and the extent to which income generated from the business in question can be strategically reduced to mitigate MAGI.

Are annuities subject to net investment income tax?

It depends - if the annuity is classified as non-qualified, then yes.

Can the Foreign Tax Credit be used to offset net investment income tax liability?

Yes, maybe. In a landmark ruling in October 2023, the U.S. Court of Federal Claims (Christensen v. United States) determined that the FTC could be used to offset the Net Investment Income Tax (NIIT). (11)

This ruling has hugely positive implications for U.S. citizens living in France because the ruling is premised on an interpretation of the U.S.-France Tax Treaty. However, it may also have exciting tax and financial planning implications for the wider U.S. expat community.

In the case of Bruyea v. United States (2024), the U.S. Court of Federal Claims addressed whether a U.S. citizen residing in Canada could apply a foreign tax credit (FTC) against the Net Investment Income Tax (NIIT). The plaintiff, Mr. Paul Bruyea, argued that under Article XXIV of the U.S.-Canada Income Tax Treaty, he was entitled to offset his NIIT liability with Canadian taxes paid on the same income. The court agreed, granting his motion for partial summary judgment and denying the government's cross-motion. This decision aligns with prior rulings, such as Christensen v. United States, which permitted FTCs against NIIT for U.S. citizens residing in France under the U.S.-France tax treaty.

In Kim v. United States (2023), a U.S. federal district court addressed whether a U.S. citizen residing in South Korea could apply a foreign tax credit (FTC) against their NIIT liability under the U.S.-South Korea Income Tax Treaty. The court concluded that the treaty's provisions did not permit offsetting the NIIT with FTCs, thereby upholding the IRS's position that FTCs cannot be used to reduce NIIT liability.

Net Investment Income Tax in the Courts

The Net Investment Income Tax (NIIT) has faced significant legal challenges, particularly from U.S. citizens residing abroad. Many argue that the tax results in double taxation since the IRS does not permit taxpayers to offset NIIT with foreign tax credits (FTCs). Courts have issued mixed rulings on this matter, with recent cases such as Bruyea v. United States (2024) affirming that certain tax treaties may allow for such offsets.

Additionally, some legal scholars and taxpayers contend that NIIT is an unconstitutional tax on capital rather than a traditional income tax. Under this argument, the tax should require apportionment among the states, a stance that echoes the constitutional challenge posed in Moore v. United States (2024), which scrutinized the legitimacy of the Mandatory Repatriation Tax.

NIIT was originally introduced as part of the Affordable Care Act (ACA) in 2013, intended as a revenue-raising measure. However, opponents argue that its application has exceeded the ACA’s original intent and that it places an undue financial burden on certain taxpayers.

Further opposition comes from business owners and investors who claim that NIIT disproportionately targets passive income streams such as rental income, dividends, and capital gains. Critics argue that the tax structure lacks sufficient exemptions for economic activities that contribute to growth and investment, leading to calls for reform or repeal.

As these legal and policy debates continue, NIIT remains a contentious aspect of the U.S. tax system, with ongoing litigation and legislative discussions shaping its future application.

It’s important that you work with your own accountant to confirm the position you will take regarding Net Investment Income Tax.

Determining Your NII Tax is Just One Piece of the Puzzle

Additional considerations that many US expats in particular must consider include:

- The implications of being married to a nonresident alien (NRA)

- How passive income generated by investments for children is classified

- Ascertaining what types of investment expenses are deductible when calculating NII

At Connected Financial Planning, we know that you work hard to ensure that you and your family are financially provided for the long term. Not only would we love to support you in that endeavor but we’re uniquely qualified to do so, thanks to our cross-border expertise and close client collaboration.

If you’re a US expat looking to optimize your financial planning strategy for the long term, schedule a consultation today.

References

- Questions and Answers on the Net Investment Income Tax

- Modified Adjusted Gross Income (MAGI): Calculating and Using It

- Topic no. 559, Net investment income tax

- IRS Form 8960

- FACT SHEET: The President’s Budget Cuts Taxes for Working Families and Makes Big Corporations and the Wealthy Pay Their Fair Share | The White House

- Types of Material Participation Tests

- Does Net Investment Income include interest, dividends and capital gains of my children that I report on my Form 1040 using Form 8814?

- Kosnitzky-Grisolia-MAG-04-13.pdf (bsfllp.com)

- Court Rules Taxpayer Can Offset Foreign Tax Credits With NIIT Liability Under Tax Treaty

Other Resources

- How to avoid the net investment income tax with material participation - SBN (sbnonline.com)

- 7 Ways to Reduce Your Income to Qualify for Roth IRA Contributions | Kiplinger

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland.