Our Process & Client Experience

Ongoing Financial Planning - Onboarding Process

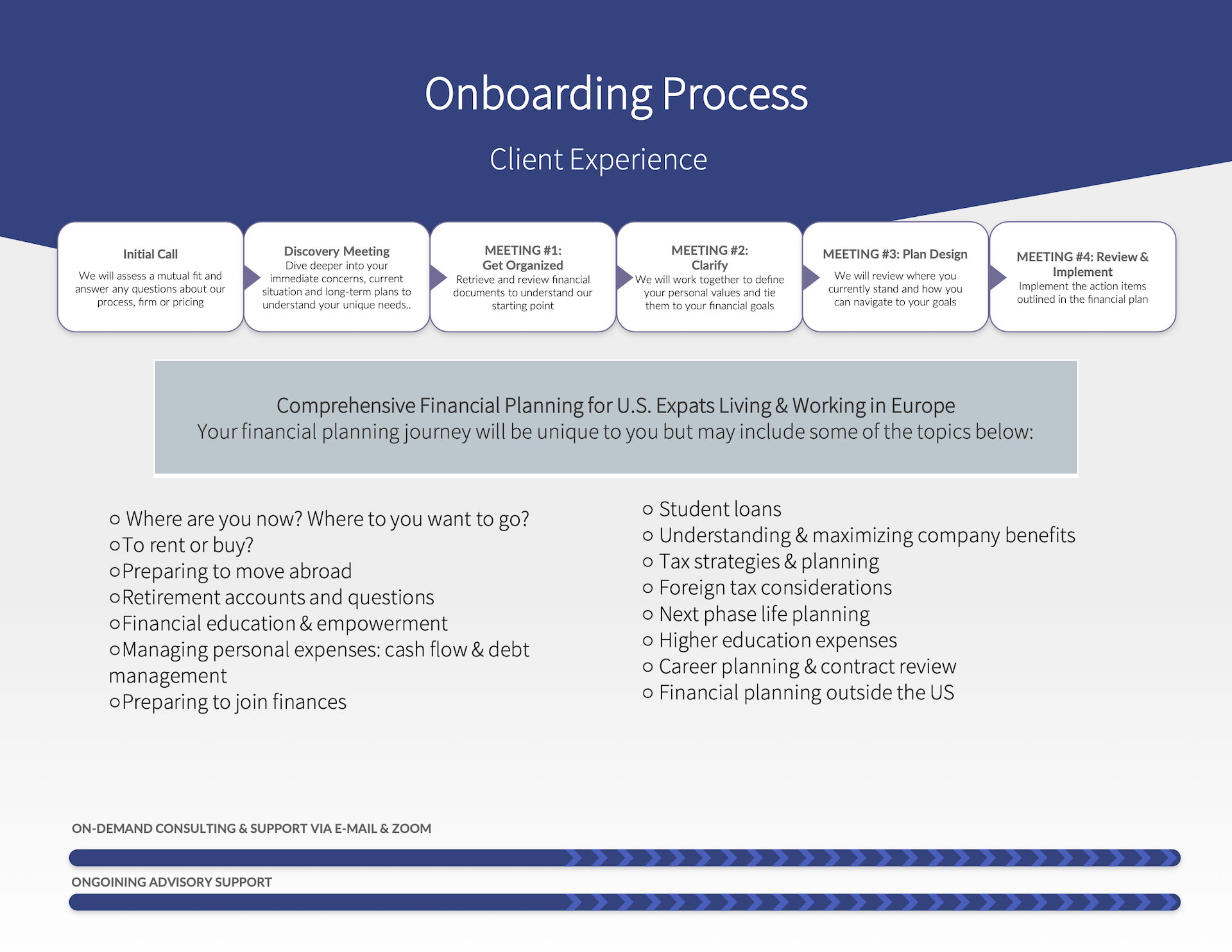

Each client engagement is tailored to individual circumstances. The onboarding process typically takes 3–6 months, depending on complexity.

- Introductory Call (15-30 minutes): We will use this time to assess a mutual fit and answer any questions about our process, firm, or pricing.

- Discovery Meeting (45–60 minutes): A detailed discussion of your financial situation, priorities, and long-term objectives. Following this meeting, you may choose to proceed by signing an engagement letter and paying the onboarding fee.

- Planning Phase: Over a series of structured meetings, we:

- Review and organize financial documentation

- Clarify outstanding items

- Model financial and tax scenarios

- Present planning recommendations and implementation steps

Ongoing Financial Planning - Ongoing Annual Planning

Following onboarding, clients continue under an annual financial planning engagement that includes at least two structured review meetings per year and ongoing advisory support as needed.

Our ongoing advisory work may include:

- Advisory review of investments

- Cash flow and savings planning

- Tax coordination and retirement contribution planning

- Insurance review (we do not sell insurance products)

- Estate and beneficiary review

- Education and student loan planning

- Charitable giving strategies

- Employee benefits analysis

- Planning for life transitions (relocation, career changes, retirement)

- Coordination with external legal, tax, or other professional advisers as appropriate

Planning Service Fees

Our Fees

As fee-only advisors, our compensation solely comes from our clients. In simpler terms, we neither receive nor accept commissions or kickbacks from brokers, banks, or any third parties. This commitment ensures that our client's best interests consistently take precedence. Should any potential conflict arise, we are dedicated to transparently disclosing it, empowering you to make informed decisions. Your financial objectives remain our foremost priority throughout our partnership. Remember, if it’s free or cheap, YOU are the product.

We generally operate on a rolling waitlist to ensure the highest client experience. A signed engagement letter and initial fee secure your onboarding date. If you have a quick question or need immediate support, you can book a paid consultation with us here.

Ongoing Financial Planning

We provide comprehensive financial and cross-border advisory services.

Annual Fee: The annual fee is based on complexity; the minimum fees listed below apply to simple situations. Following our comprehensive onboarding process, we typically meet twice a year, with additional support available as needed between meetings. The annual fee is divided into quarterly payments.

- Individual Planning: from $5,460 per year

- Family Planning: from $6,550 per year. We include families of all kinds in this tier, including married couples, partnered individuals, and those with dependent children.

- Small Business Planning & Complex Situations: from $8,188 per year. We include anyone with self-employment income in this category.

Onboarding Fee: A one-time onboarding fee of 2,500 USD/EUR/CHF* is charged for individuals, and 3,500 USD/EUR/CHF* for families and complex situations, at the beginning of the engagement to cover initial setup, data collection, and planning design. Our onboarding fee is due with your signed engagement letter and secures your onboarding date.

Who We Work Best With

Our comprehensive financial planning services are best suited for internationally mobile U.S. expats and their families:

- High-income U.S. expat individuals and families (typically earning $250,000 USD/EUR/CHF or more annually) with growing net worth and the capacity to save consistently and aggressively toward long-term goals, or

- Established professionals and families with a net worth of approximately $1.5 million or more who are managing multiple financial priorities (retirement, education, property, or business interests); or

- Individuals or couples in or within five years of retirement with a net worth of approximately $2 million or more seeking coordinated tax, cash flow, and cross-border retirement planning.

These thresholds help ensure our services provide meaningful, long-term value and impact.

If you don’t currently meet these criteria, we still welcome you to book a paid consultation here. Our one-time Expat Expert Calls are available to anyone seeking guidance on cross-border tax and financial planning topics.

Advanced Planning & Tax Concierge Service

This service is designed for internationally mobile professionals and families with complex U.S. and foreign tax considerations requiring structured, ongoing coordination. Services may include multi-country tax-planning oversight, collaboration with external tax advisers, and integrated financial-planning support.

Annual Fee: from $26,500 per year, based on complexity, number of jurisdictions involved, and filing requirements. Fees are billed quarterly.

Onboarding Fee: 3,500 USD/EUR/CHF*, charged to cover the initial planning, document review, and cross-border coordination. Our onboarding fee is due with your signed engagement letter and secures your onboarding date.

Custom Projects

If you have an immediate or quick question, we invite you to book a paid consultation here.

For individuals considering working with us on a project, the first step is to book a paid consultation. Should we move forward together, the consultation fee will be applied toward your project fee.

We are passionate about serving clients with a diverse range of planning needs. We are happy to take on custom projects as we have capacity. Our starting project fee is 5,300 USD/CHF/EUR, with most projects priced between 7,500 and 15,000 USD/CHF/EUR.

*Clients resident in Switzerland are subject to 8.1% VAT

Considerations For Complex Situations For All Engagements

In any of our above pricing options, we generally define your situation as complex if any of the following applies to you:

- You are a corporate expat on a limited expat contract

- You are planning an international move within the next 12 months

- You own a business, or are you in the process of organizing one

- You are involved or have ownership with foreign entities

- You are considering purchasing foreign real estate within the next 12 months

- You have complex equity compensation considerations

- You are a senior executive with a complex compensation structure

- You have immediate estate planning needs and considerations

- You are planning on retiring within the next five years