The Switzerland tax rate may not be top-of-mind in the initial surge of excitement around moving abroad – especially if you’re still in the daydreaming stages of retiring in Switzerland. However, questions relating to cross-border financial planning inevitably bubble to the fore when considering the cost of moving to Switzerland.

As an American living in Switzerland, there will be many new taxes to get familiar with, including Swiss cantonal taxes and municipality taxes.

While tax in Switzerland has somewhat of a mysterious aura due to the country’s deep ties to the international banking and finance sectors, the country holds endless appeal for people seeking a move abroad from the U.S. to an exciting and (with the right strategy) tax-efficient place to live.

Becoming a Swiss Tax Resident

In contrast to many of the European countries it borders, Switzerland is known as an extremely efficient place.

For example, when you first move to Switzerland, you will register at your local municipality (commune/Gemeinde) in your canton of residence. (1)

Registration with your local municipality must be done within 14 days of arriving and before you begin working.

If you are registering yourself as an individual, this process also activates your Swiss tax residency. Moreover, if you move to Switzerland for full-time work, you are technically subject to Swiss income taxes from the day you arrive. However, factors such as the existence of a double taxation treaty or Swiss internal law can impact your rate of taxation in Switzerland.

Additionally, Swiss health insurance is compulsory and must be purchased within three months of your arrival in Switzerland.

Types of Swiss Taxes

Annual tax returns in Switzerland typically cover federal, cantonal, communal, wealth, and church taxes, as applicable.

We get into the weeds of this below, but, generally, there can be a large disparity in taxes owed depending on where you live in Switzerland.

Who Needs to File a Tax Return in Switzerland?

Not all residents in Switzerland must file a tax return.

Many foreign nationals pay taxes directly on a pay-as-you-earn (PAYE) basis (also known as “Quellensteuer” or “impôt à la source”).

The tax filing threshold for Quellensteuer is 120,000 Swiss Francs (CHF). This threshold equals around 130,000 USD.

Typically, a foreign national will not need to file a Swiss tax return if they:

- fulfill the criteria and

- do not meet the wealth threshold established by their canton.

Important callout: The above does not apply to Swiss citizens or Permit C holders in Switzerland. If you reside in Switzerland on a Permit C or are a citizen, you must file an annual Swiss tax return.

Are Taxes High in Switzerland?

Compared to other countries in the OECD, taxes in Switzerland are not very high. At the federal level, the highest Swiss tax rate is 11.5%. Compare that to the highest U.S. federal tax rate of 37% and, at a cursory look, it may seem like Switzerland is the more tax-efficient choice between the two.

However, when considering your tax liability, particularly in a foreign country, it’s important to be aware of all the different types of taxes you might be liable for, and why.

Diving Deeper

All Swiss tax residents are subject to tax on their worldwide income, but non-residents are only taxed on their Swiss-derived income. Additionally, a double taxation agreement, Totalization Agreement, and estate tax treaty also exist between Switzerland and the U.S.

Interestingly, Switzerland may be considered a slightly better place for a single U.S. person to live and pay taxes, while for a dual-income household with two children, there may be virtually no tax difference, broadly speaking. (2)

Switzerland Uses a Progressive Tax System

This means that the amount taxpayers owe depends on their income. The more you earn, the more you’re taxed.

As mentioned, Switzerland levies many different types of taxes. Taxes are collected by the cantons (3), which can loosely be equated to the state that you live in. When the Swiss tax season opens, your canton’s tax administration office will send you your tax return to complete.

The total amount of tax levied per individual can vary enormously because it’s subject to:

- earned income

- investment income and

- where you live in Switzerland.

Additionally, Switzerland handles its wealth tax in a unique way that does not apply capital gains tax to investment income. (This also varies by canton.)

Tax residents of Geneva have the highest cantonal tax rates in the country at 45%. However, it’s worth noting that some municipalities have taxes exceeding even the highest cantonal tax. (4)

For a comprehensive breakdown of tax brackets in Switzerland, PWC provides a detailed overview of the Switzerland tax rates associated with each filing status. (5)

The Tax Authority in Switzerland

The Federal Tax Administration is the federal tax authority in Switzerland, however, there are also 26 cantons in the country. Cantonal tax rates vary and depend on in which canton you live.

For U.S. expats, the cantons are akin to states. Similarly to how you must file a federal tax return every year, in most cases, a state tax return is also due.

VAT in Switzerland

Switzerland charges Value Added Tax (VAT) on goods and services. Additionally, if you are a business owner and your revenue exceeds CHF100,000 (around 110,000 USD) per year, you must register for VAT.

In 2025, the standard VAT tax rate in Switzerland is 8.1%, though there are certain categories that qualify for a reduced rate (2.6%). The accommodation VAT rate is 3.8%. (6)

Lump-sum Taxation Switzerland (For Certain Foreign Nationals)

Lump-sum taxation in Switzerland is also known as expenditure-based taxation. (7) It is a simplified assessment procedure for foreign nationals who are domiciled in Switzerland but not gainfully employed in the country.

It’s worth mentioning that lump-sum taxation is not the same as lump-sum payout tax, which is generally available throughout Switzerland and is a powerful planning tool. (8)

The appeal of expenditure-based taxation lies in that it provides a special way of assessing income and wealth, although the regular tax rates are applied in calculating the tax amount.

Today, this form of taxation is available to qualifying foreign nationals who:

- are not Swiss citizens,

- reside in the cantons of Thurgau, St Gallen, Lucerne, or Bern,

- make Switzerland their tax domicile for the first time or after at least ten years spent outside the country, and

- are not gainfully employed in Switzerland.

Note: Fewer than 0.1% of taxpayers are taxed on an expenditure basis in Switzerland. (9) The right to expenditure-based taxation expires when a person acquires Swiss citizenship or becomes gainfully employed in Switzerland.

U.S.-Switzerland Tax Treaty

Unlike the vast majority of countries, the U.S. operates a citizenship-based taxation system.

This means that both U.S. citizens and permanent residents must file a yearly tax return with the IRS, even if they reside abroad (e.g., Switzerland).

Most Americans living in Switzerland will need to file two tax returns. The first tax return you file will typically be with your cantonal tax administration. The second one is filed with the American Internal Revenue Service (IRS).

When filing with the IRS, you will need to apply the appropriate credits and exclusions, as well as file the correct administrative forms (e.g., FBAR).

All this must be done while ensuring you are financially and strategically aligned with the best approach given the U.S.-Switzerland Tax Treaty.

In many cases, consulting with experts in Swiss taxes and US expat taxes is beneficial.

Tax Optimization and Planning Strategies

Here are several areas to consider:

Cantonal Tax Optimization

One of the most significant ways to influence your Swiss tax burden is by choosing a canton with favorable tax rates.

Tax rates vary substantially across cantons, so researching and selecting a canton aligned with your financial situation can lead to considerable savings. Use online resources to compare cantonal tax rates and understand their specific regulations.

Swiss Pension Planning (Pillar System)

Switzerland's three-pillar pension system offers valuable tax benefits. Understanding and strategically utilizing these pillars is crucial for long-term financial planning.

- Pillar 1 (Swiss state pension) ensures basic living requirements in retirement.

- Pillar 2 (occupational pension), offered through your employer, is mandatory for most employees.

- Pillar 3 (private pension) offers tax-advantaged savings opportunities. Contributions to a pillar 3a account, in particular, are tax-deductible up to a certain annual limit.

Deductions

Take advantage of available deductions to reduce your taxable income. Common deductions in Switzerland include:

- Contributions to pillar 3a (as mentioned above).

- Work-related expenses (commuting costs, professional development, etc.).

- Charitable donations (to recognized organizations).

- Premiums paid on life and health insurance policies

- Costs for childcare.

- Mortgage interest payments

Wealth Tax Considerations

Switzerland levies a wealth tax at the cantonal and municipal levels. Strategically managing your assets can help minimize this tax.

Consider diversified investment portfolios and explore options for asset allocation that align with your long-term financial goals.

Real Estate Considerations

Owning property in Switzerland has tax implications. Property taxes vary by canton and municipality. Be aware of these taxes, as well as potential deductions related to mortgage interest and property maintenance.

Tax-Efficient Investments

Structure your investment portfolio to minimize your tax burden. U.S. citizenship places the unique burden of structuring an investment portfolio such that it does not trigger punitive filings requirements and subsequent payments to the IRS.

U.S. Expat Tax Considerations

For U.S. citizens residing in Switzerland, navigating both Swiss and US tax obligations is essential. Make sure to familiarize yourself with the Foreign Tax Credit (IRS Form 1116) and the Foreign Earned Income Exclusion (IRS Form 2555), which are essential tools for U.S. expats to be aware of when tax season comes around.

Strategic Retirement Account Planning

Develop a cohesive strategy for your retirement accounts considering both U.S. and Swiss regulations. This may involve analyzing the treaty to understand how different account types are treated for taxation purposes, contribution limits and how moving abroad impacts your ability to contribute to certain accounts, and potential tax implications more broadly.

Net Investment Income Tax (NIIT)

Understand how the Net Investment Income Tax might apply to your investment income. This tax is commonly referred to as “3.8 net investment income tax” because 3.8% is the amount of tax added to excess investment income above a certain threshold.

Passive Foreign Investment Company (PFIC) Rules

Be aware of the complex Passive Foreign Investment Company (PFIC) rules, which can affect U.S. taxpayers who invest in certain foreign funds. PFIC tax rules are complex to understand, especially when they apply to an account that would normally be a finally-efficient choice for someone not bound by U.S. citizenship-based taxation rules.

💡Did you know? Our team at Connected Financial Planning is led by a certified cross-border financial planning expert – and she’s an American based in Switzerland. Request a consultation today!

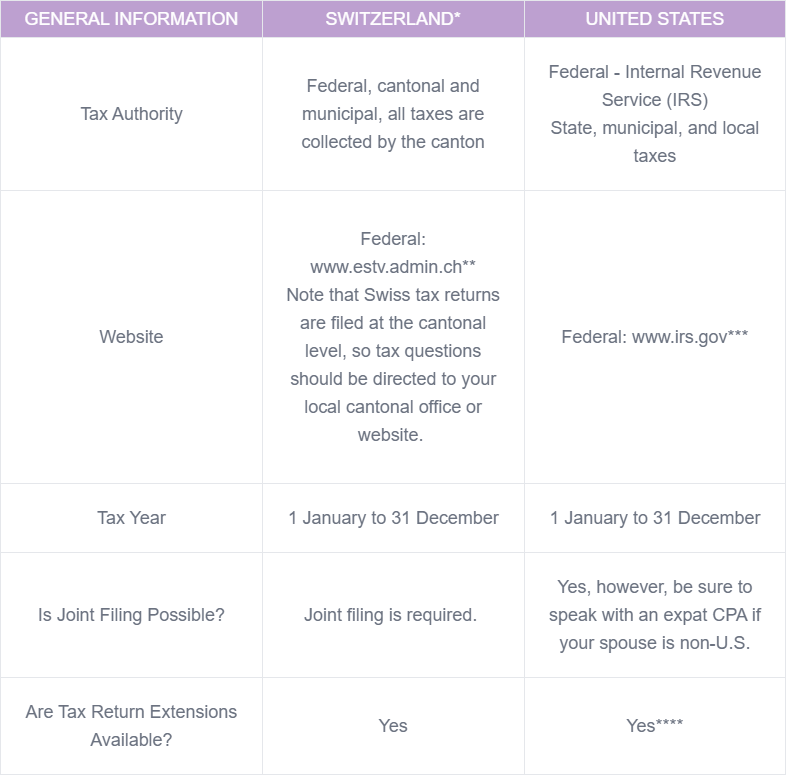

Taxes in Switzerland vs USA

* Reference #10

*** IRS website

**** US Tax Planning for Expats

Wrapping Up: Navigating Taxes in Switzerland and the US

Taking time to dig in and research the financial implications of an international move will be key to feeling secure in your approach to Switzerland taxes.

As you’ve read, in many cases, Americans living in Switzerland may not even need to file. In others, it will be necessary to build an expat financial team to advise the best approach to tax and financial planning.

Taxes in Switzerland - FAQ

Is there a wealth tax in Switzerland?

Switzerland imposes a wealth tax at cantonal and municipal levels, but not the federal level. Wealth tax rates vary considerably, ranging from 0.1% to 1%.

Do foreigners pay taxes in Switzerland?

Yes, if they qualify as tax residents in Switzerland. Note that taxes are collected by the cantons, even federal ones. If you have a question about your particular situation, you will need to visit the tax office in your canton.

References

- Notifying a change of address at the register of the population / residents' registration office

- Income Tax in Switzerland Compared - moneyland.ch

- Taxes in Switzerland (ch.ch)

- Swiss Tax Rates by Canton

- Switzerland - Individual - Taxes on personal income (pwc.com)

- Increase in VAT rates from 2024 (admin.ch)

- Lump-sum taxation (admin.ch)

- Lump-sum payout tax: The seven key points | Credit Suisse Switzerland (credit-suisse.com)

- Taxpayers qualifying for Lump-Sum Taxation in Switzerland

- Local tax information for Switzerland

Additional resources

- Taxing Wages - Switzerland

- Falling wealth taxes contributing to rising wealth concentration – KOF Swiss Economic Institute | ETH Zurich

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She’s spent over a decade working with US expats on US tax and financial planning issues. She is passionate about working with US expats and their families to help secure their financial future reflective of their core values. Arielle grew up in New York and has lived throughout the US, Germany, and Switzerland.