After reviewing Pillar 1, next up in our series about the Swiss Pension System is Pillar 2: The Occupational Pension.

Understanding Swiss Pension Pillar 2 is particularly important for U.S. expats employed in Switzerland because navigating contributions and withdrawals ideally involves significant strategy and planning.

Note: Historically, “Swiss Pillar 2” has solely referred to the second pillar in the three-part Swiss Pension System. However, legislation passed via public vote in the summer of 2023 introduced the global minimum tax, which is also known as Pillar 2. (1) In this article, references to Pillar 2 solely refer to the Swiss Occupational Pension.

Swiss Pillar 2: Occupational Pension

The second pillar in the Swiss Pension System is most similar to the concept of a U.S. 401(k) and 403(b).

However, unlike these U.S. accounts, they can come with surprisingly complicated tax reporting requirements (more on this later).

The 2nd Swiss Pillar is comprised of two parts:

Mandatory benefits (BVG-LPP)

Contributions are mandatory for adults aged 25 and older employed on a Swiss work contract and earning a salary of CHF 22,680 (2025) or higher. (2) Employers are obliged to match employee contributions and may (and often do) choose to contribute more.

Voluntary benefits

For those who are self-employed, you may choose to make voluntary contributions. If you choose to make these contributions, you must contribute both the employer and employee portions.

Swiss Pension Pillar 2 Contributions

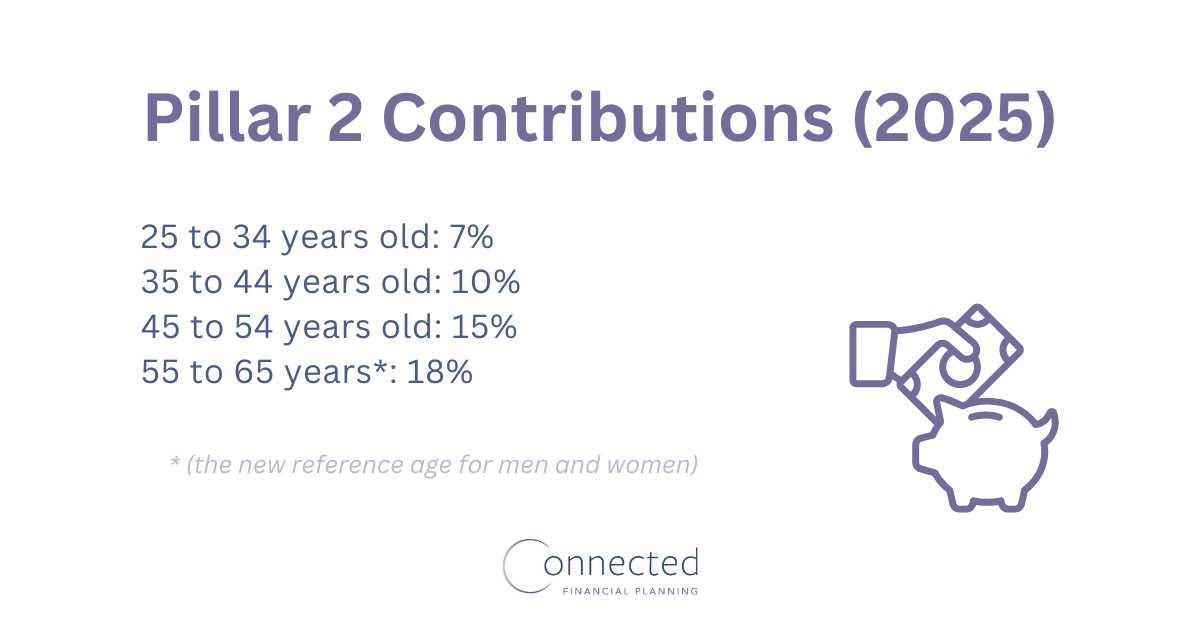

The amount you contribute to Pillar 2 is age-dependent:

Swiss law requires the employer to pay at least 50% of the contributions.

As mentioned earlier, Swiss employers often offer higher contributions or supplementary plans to increase retirement benefits.

However, this commonplace offer may have an adverse cross-border tax effect, i.e., U.S. expat tax complications may increase. We strongly recommend consulting with a specialized U.S.-Switzerland cross-border tax expert to understand what higher contributions or supplementary plans mean for your U.S. tax reporting.

Taxation During Contribution Years

In Switzerland, an individual’s Pillar 2 contributions are not taxed at the time of contribution. Instead, they are subject to taxation upon drawing distributions (when you retire).

Does the U.S.-Swiss Tax Treaty Recognize Swiss Pillar 2 Benefits?

⚠️ The U.S.-Swiss Tax Treaty does not include a provision recognizing Pillar 2 benefits as “qualified retirement plans.”

This is unfortunate for U.S. expats living and working in Switzerland because Pillar 2 benefits are thus subject to unfavorable tax treatment by the U.S.

What this looks like in practice is that when your employer makes contributions, they are immediately considered vested. (3)

This consideration results in:

- No U.S. tax deduction for your contributions and

- Yearly taxable income from your employer’s contributions.

Taxable Compensation: Switzerland VS the U.S. (Example)

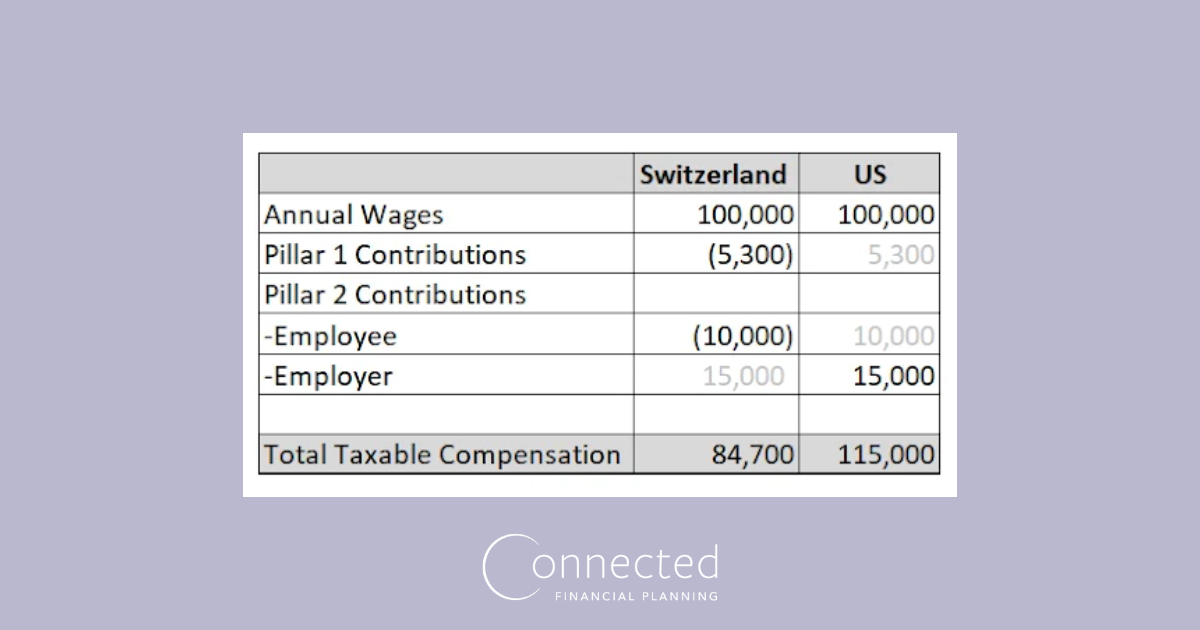

In the above example, you can begin to see the difference in calculating your taxable compensation in Switzerland and the U.S..

Switzerland reduces your gross salary by your Pillar 1 and Pillar 2 contributions. On the other hand, the U.S. adds your employer contributions to your gross salary.

While your initial gross salary is the same, there is a 30,300 difference in taxable compensation, with higher exposure on the U.S. side. This does not factor in additional foreign currency movement between the Swiss Franc and the US Dollar.

Taxation During Distribution Years

Upon leaving or choosing to retire in Switzerland, there are three options for receiving Pillar 2 benefits:

1. An annuity

For residents of Switzerland, annuities will be taxed at ordinary income tax rates.

Any Swiss tax paid can then be used as foreign tax credits on your U.S. tax return.

For non-residents of Switzerland, annuities will only face Swiss taxation if there is no income tax treaty in place with your resident country or the treaty grants the taxation right to Switzerland.

Note: If you are living in the U.S., this does not apply, as the U.S.-Swiss tax treaty grants taxation rights to the U.S. in this case.

Additionally, there are exceptions to the above, which can apply if your Pillar 2 funds are from public services.

Regarding U.S. taxes

Since your contributions were already taxed, you can recover a portion of that tax basis with each distribution.

Any amount that exceeds your tax basis will be taxed at your U.S. ordinary income tax rates. You can then use any Swiss taxes paid as foreign tax credits. See the example below.

2. A lump sum

For residents of Switzerland, lump sum distributions receive extremely favorable tax rates. These vary depending on the location of tax residency upon distribution, but are typically between 4 and 15%.

For non-residents of Switzerland, lump sum tax rates are applied. If you are a U.S. resident at the time of distribution, the amount of Swiss taxes withheld will be refundable.

For your U.S. taxes, any distributions in excess of your tax basis will be taxed at U.S. ordinary income tax rates.

As you can see, it’s imperative to keep track of your employee and employer contributions each year.

When you retire, you are then able to use that tax basis to decrease your taxable compensation. See example below.

3. An annuity and lump sum

For both residents and non-residents of Switzerland, you have the option to choose a combination of annuity and lump sum distributions.

Each option is taken from the same ‘pool’ of benefits, so taking one will decrease the amount available for the other option.

Career Change Rollovers

When changing from one Swiss employer to another, your total Pillar 2 benefits are rolled over into a new pension account with your current employer.

As long as your Pillar 2 contributions have been correctly reported up to this point, this rollover should not result in any additional taxable income.

What Happens During a Career Break?

When taking a career break, your total Pillar 2 benefits will likely be transferred from your prior account into a blocked account.

Americans are often required to keep this amount as a cash balance, as most investment options result in U.S. punitive taxes.

In recent years, the Swiss digital pension platform VIAC has provided low-cost investment options that may be attractive to Americans.

However, it is always best to check with your financial planner or U.S. tax advisor before committing to a new investment strategy.

Swiss Pillar 2 and U.S. Taxes

In addition to reporting your annual employer pension contributions, make sure to include your Pillar 2 account balance on Form 8938, Statement of Specified Foreign Financial Assets. (4)

Wrapping Up Swiss Pillar 2

The U.S. does not treat Pillar 2 as a “qualified retirement plan.”

As such, contributing to these accounts will lead to an imbalance between your U.S. and Swiss tax reporting.

Going further, if a Swiss Pillar 2 pension contains investments that qualify as a Passive Foreign Investment Company (PFIC), that PFIC is typically reportable on Form 8621.

Swiss Pillar 2 accounts are also reportable for FBAR (Foreign Bank and Financial Account Reporting) and FATCA (Foreign Account Tax Compliance Act) purposes.

Is the 2nd pillar mandatory in Switzerland?

Yes, Pillar 2 contributions are generally mandatory for employees in Switzerland. The 2nd pillar is a key part of the three-pillar Swiss pension system, complementing the state pension and providing additional retirement income.

Read next: Swiss Pillar 3

References

- It’s official: Switzerland to implement Pillar 2 in a gradual approach

- Pension Scheme (2nd Pillar Benefits)

- Vesting: What It Is and How It Works

- About Form 8938, Statement of Specified Foreign Financial Assets

Additional resources

- Switzerland - Tax Treaty Documents

- Voluntary pension contributions: Should you pay into the second pillar or Pillar 3a?

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She’s spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure their financial future reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland.