Pillar 3 Switzerland: Private Pension is the third and final part of our article series about the Swiss Pension System.

Be sure to review Pillar 1 (the Swiss pension system explained) and our article on the 2nd pillar (occupational insurance) if you have not already done so. Note that the benefits in Pillar 1 and Pillar 2 are not typically sufficient to fully maintain one’s standard of living.

Investing in a private pension plan in Switzerland appears to offer a sustainable solution.

But appearances can be deceiving.

If you’re a U.S. expat, you’ll want to proceed with caution and read the following closely.

What is Pillar 3 in Switzerland?

Most similar to the concept of a Traditional IRA, the third pillar of the Swiss Pension System is comprised of two parts, which we’ll outline below. (1)

Pillar 3a (Restricted Pension)

As the name indicates, contributions to Pillar 3a are “restricted” to the retirement account and can only be withdrawn under certain conditions. Pillar 3a is also known as the Tied Pension Provision. Contributions to this account have tax advantages in Switzerland.

Pillar 3b (Unrestricted Pension)

Contributions to Pillar 3b can be freely withdrawn. However, they have fewer tax advantages in Switzerland when compared to Pillar 3a.

Contributions

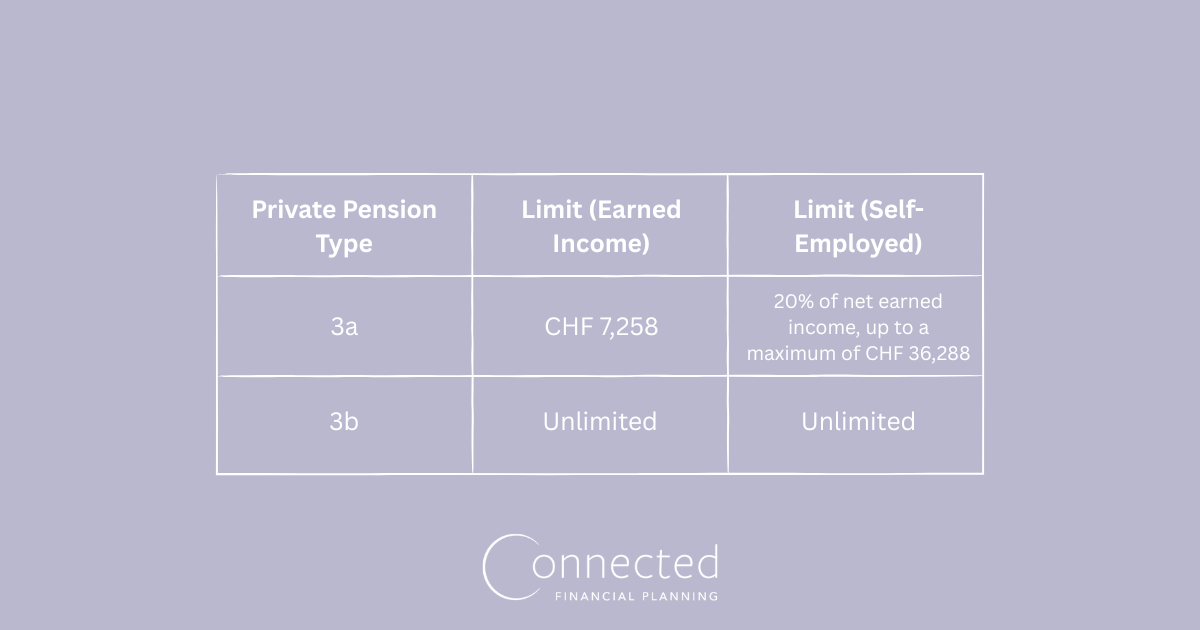

As noted previously, both Pillar 3a and Pillar 3b are private pensions, to which contributions are voluntary. The third pillar incentivizes individuals to save for retirement by offering additional tax savings in the year of contribution, similar to a Traditional IRA in the U.S..

There are numerous product types, including life insurance, savings accounts, investment accounts, etc., which all have different implications when it comes to your U.S. taxes.

How does the IRS treat Pillar 3?

The U.S. does not recognize Pillar 3 as a Traditional IRA, but as a regular brokerage account. This is an important distinction with significant implications for U.S. tax filing, so hold onto this thought. We’ll come back to it later on.

Annual Swiss Private Pension Limits in 2025 (2)

Evaluating Private Pension Options in Switzerland

Taxation During Contribution Years

In Switzerland, how your private pension is taxed depends on the type of plan you have.

Pillar 3a Accounts

Contributions can be deducted from your taxable income, therefore decreasing your overall tax balance. Any interest or gains on the account are tax-exempt until withdrawn.

Pillar 3b accounts

There is a limited deduction available if you purchase an insurance product. The surrender value (AKA the amount received if the life insurance plan is ended prematurely) is subject to a wealth tax.

The wealth tax ranges from 0.13% to 1.1% and is assessed based on the qualifying taxpayers’ assets. (3)

Reminder

In the U.S., Pillar 3 is not considered a “qualified retirement plan” for tax purposes, as is the case with a Traditional IRA.

Therefore, contributions cannot be deducted from your taxable income, increasing your overall tax balance.

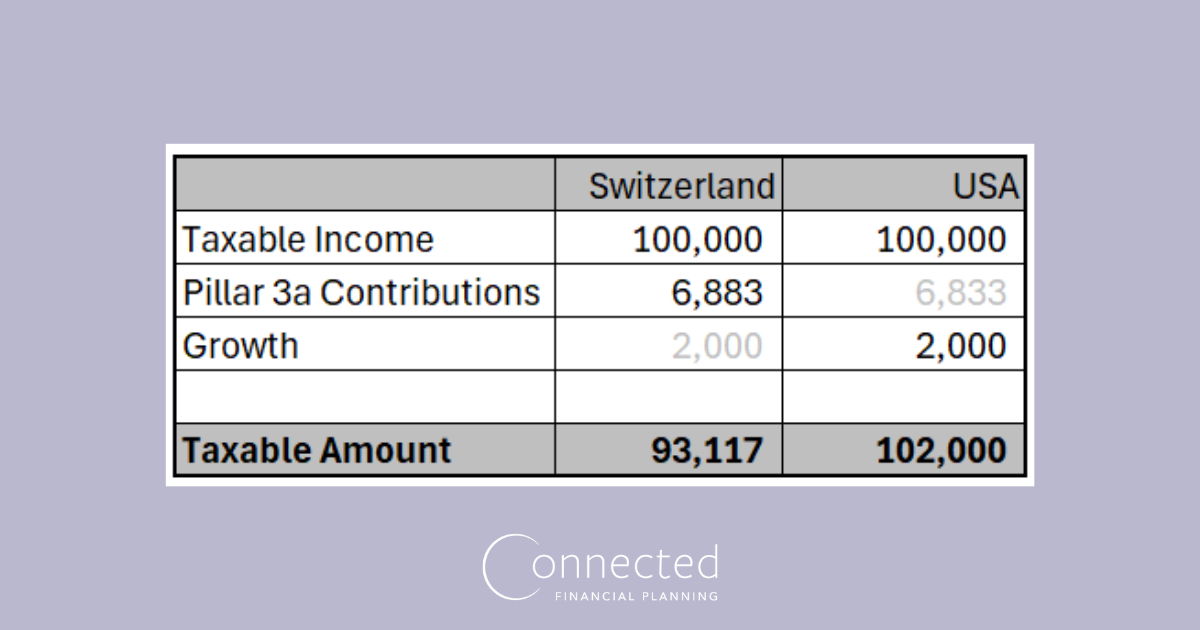

Any interest or gains on the account should be reported and are taxable each year. See Pillar 3a example below:

In the above example, you can begin to see the difference in calculating your taxable compensation in Switzerland and the U.S.

Switzerland reduces your taxable income by your Pillar 3 contributions and defers any account growth until you receive distributions.

The U.S., on the other hand, does not allow for an income deduction for Pillar 3 contributions and taxes the account growth yearly.

While your initial taxable income is the same, there is an $8,883 difference in taxable income.

Private Pension Taxation During Distribution Years

In Switzerland, taxation differs depending on the type of private pension plan.

For Pillar 3a accounts, you can withdraw your benefits under the following conditions:

- Up to five years before the full retirement age

- Relocation outside of Switzerland

- You become self-employed

- Upon purchasing a home

Early withdrawal preferential tax rates may apply, depending on the reason for early withdrawal and your cantonal location

For Pillar 3b accounts, you can withdraw your benefits at any time

These withdrawals generally do not result in additional taxable income but are still subject to Switzerland’s wealth tax.

In the U.S., there is no tax benefit for Pillar 3a or 3b

Any distributions in excess of your tax basis (AKA total prior contributions) will be fully taxable.

Interest or yearly capital gains should be taxable in the year received, but any excess will be taxable when distributed.

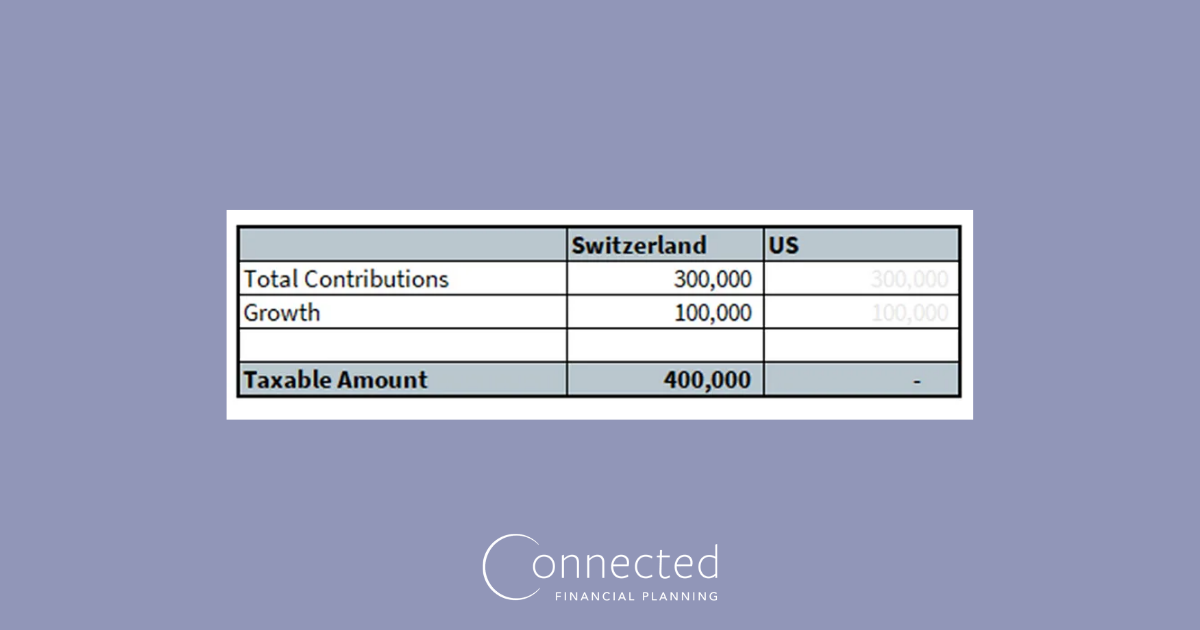

See Pillar 3a example below:

In the above example, you can begin to see the difference in calculating your taxable compensation in Switzerland and the U.S..

Switzerland taxes your full contributions and account growth at the time of distribution.

The U.S. already taxes your contributions and account growth yearly, so there is no additional tax at the time of distribution (unless there is excess growth not previously reported).

So, Should U.S. Taxpayers Open a Private Pension in Switzerland?

Due to the lack of tax benefits, Pillar 3 pensions are not recommended for those who are subject to U.S. taxation.

Most of the plans offered under Pillar 3 face punitive taxes in the U.S. and are often actively managed, meaning they have high fees and high-risk regulation (resulting in low returns).

Important U.S. Tax Reporting Notes

If you choose to invest in a Pillar 3 pension, keep in mind it will lead to additional U.S. tax reporting requirements. Notably, the IRS will classify Swiss Pillar 3 accounts as a foreign trust, which must be reported via IRS Form 3520. (4)

Additional U.S. tax reporting may include:

- PFIC - Form 8621: Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund

- FBAR - Report of Foreign Bank and Financial Accounts

- Net Investment Income Tax (NIIT)

Conclusion

As we’ve stated, the U.S. does not treat a private pension plan in Switzerland as a qualified retirement plan.

Therefore, contributing to a Swiss private pension account will lead to greater challenges in streamlining and optimizing your U.S. and Swiss tax reporting.

Holding a private pension account will also trigger additional yearly taxable income and filing requirements on your U.S. tax return.

This effectively means you will pay a specialized CPA more money to properly file accounts that will be punitively taxed by the U.S.

If you currently have a Pillar 3 account, don’t despair!

By collaborating with a Swiss-specialized cross-border financial expert and tax advisor, you can work to sustainably correct and legally optimize your situation.

References

- 3rd pillar - ch.ch

- Changes in Switzerland in 2025 – overview of key changes – Swiss Life

- Wealth Tax - Taxolution Advisory LLC Taxolution Advisory LLC

- https://www.irs.gov/forms-pubs/about-form-3520

Additional resources

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland.