PFIC rules can be one of the more complex areas of tax compliance for U.S. expats – and they’re easily overlooked.

Try investing in foreign funds with a foreign investment account, and you’ll likely end up researching, “What is a PFIC?”

The term stands for Passive Foreign Investment Company, and it typically applies to certain non-U.S. mutual funds, ETFs, and other pooled investment vehicles.

For many Americans living abroad, investing in local funds seems like a logical way to diversify. However, these investments can trigger unfavorable tax treatment and burdensome reporting requirements under U.S. tax law.

Setting the Stage

PFIC rules apply universally to U.S. citizens living overseas, regardless of whether they move to Europe or somewhere else in the world.

U.S. citizens and green card holders must be aware of citizenship-based taxation, the U.S. tax regime requiring citizens and certain other U.S.-connected persons to file an annual tax return regardless of where they live.

The following guide provides a detailed overview of PFICs (reported on IRS Form 8621), highlighting their implications and offering strategies for American expats to navigate these complexities efficiently.

Understanding Passive Foreign Investment Companies (PFICs)

As an investor, you’re likely familiar with the concepts of mutual funds, index funds, and exchange-traded funds (ETFs). However, the taxation and reporting rules that govern a PFIC are considerably stricter and more complex.

A Passive Foreign Investment Company (PFIC) is a non-U.S. investment entity that meets specific criteria under U.S. tax law. The PFIC rules aim to prevent U.S. taxpayers from avoiding taxes by investing in foreign entities. PFICs include various investment funds and certain types of pension investments located outside the United States.

What is a PFIC for U.S. Tax Purposes?

An investment is classified as a PFIC if it meets at least one of the following tests:

- Income Test: If 75% or more of the foreign corporation’s gross income is passive income (such as dividends, interest, royalties, annuities, and rental income), it qualifies as a PFIC.

- Asset Test: If 50% or more of the foreign corporation’s assets generate or are held for the production of passive income, the company is a PFIC.

These tests are applied annually, meaning an investment could qualify as a PFIC one year and not the next based on its income and assets.

What is a PFIC example?

Common examples of PFICs that American expats might encounter include:

- Foreign Mutual Funds: Investment funds registered outside the U.S.

- Foreign Exchange-Traded Funds (ETFs): ETFs listed on foreign stock exchanges.

- Foreign Real Estate Investment Trusts (REITs): Companies investing in real estate outside the U.S.

It's important to note that individual shares in foreign companies do not qualify as PFICs. Only pooled investments are classified as PFICs.

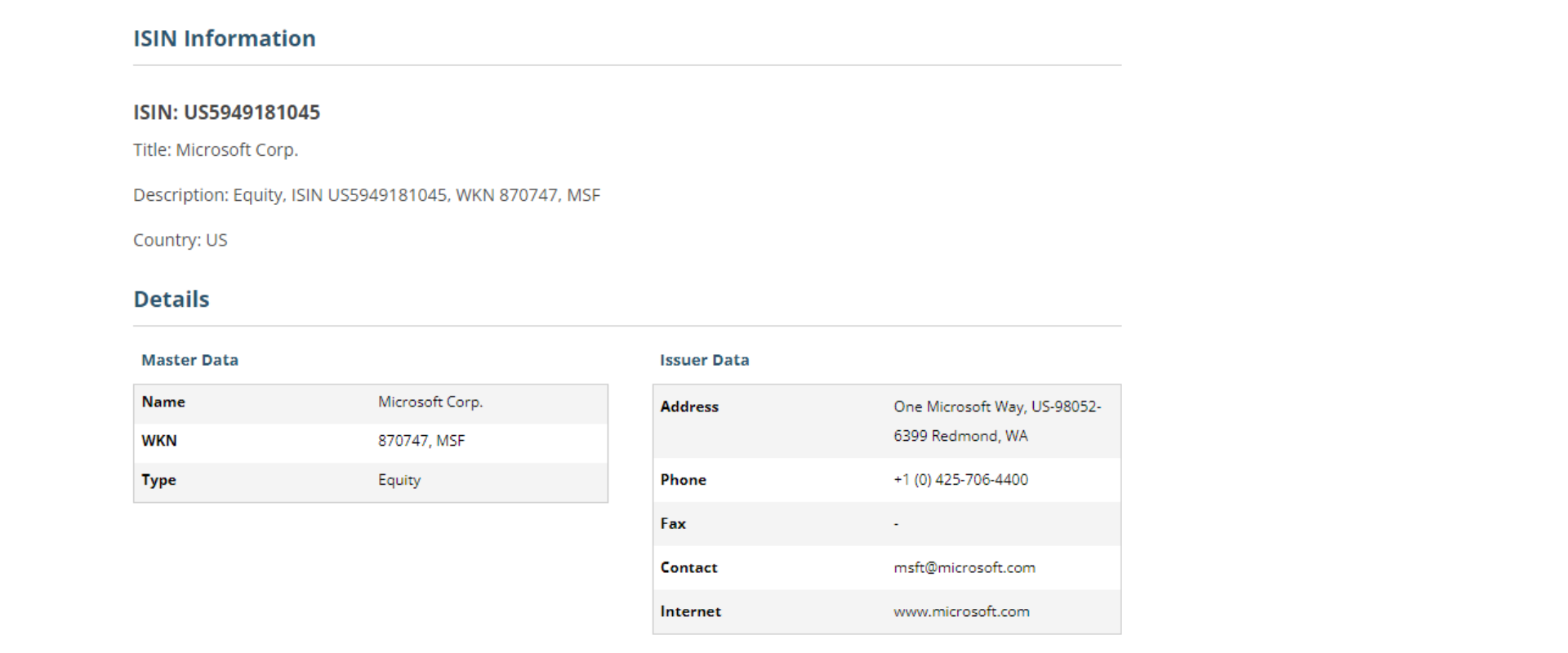

Identifying a PFIC Using ISIN

Source: www.isin.org

An International Securities Identification Number (ISIN) can help determine if an investment is a PFIC. (1) An ISIN starting with "US" indicates that the investment is U.S.-registered and not a PFIC. If it begins with other letters, the investment is classified as a PFIC.

Taxation of PFICs

The IRS offers three methods for taxing PFICs: Excess Distribution, Market-to-Market (MTM), and Qualified Electing Fund (QEF).

Each method has distinct rules and tax implications:

- Excess Distribution Method: The default and often most burdensome method, where U.S. taxes are deferred until earnings are distributed or the PFIC is sold. The excess distribution amount is calculated by spreading out the distribution over the holding period on a pro-rata basis, with interest charges potentially resulting in significant tax liabilities.

- Market-to-Market (MTM) Method: Electing the MTM method on Form 8621 allows investors to recognize annual gains based on the PFIC's value at the end of the tax year. Gains are taxed as ordinary income, while losses can offset gains in current years.

- Qualified Electing Fund (QEF) Method: This method includes the investor's pro-rata share of the PFIC’s earnings in their annual gross income, which may be classified as ordinary income or capital gains. The QEF election requires filing Form 8621 in the first investment year, with the PFIC providing an annual information statement. (2)

Reporting Requirements for PFICs

American expats must file Form 8621, "Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund," if they:

- Receive a distribution from a PFIC.

- Recognize a gain on the disposition of PFIC stock.

- Make a QEF or MTM election.

What is Not a PFIC? Exceptions to Filing Form 8621

- Foreign Pension Plans: Certain foreign pension plans may be exempt from PFIC reporting requirements until distributions are made. Adjustments or early cash-outs may nullify this exemption.

- Controlled Foreign Corporation (CFC): If the PFIC also qualifies as a CFC, only Form 5471 needs to be filed. (3) A CFC is a foreign corporation where specific U.S. shareholders own more than 50%, with shareholders owning at least 10% considered for classification.

Avoiding PFICs

U.S. taxable investors should focus on building a globally diversified investment portfolio through U.S.-registered funds to avoid PFIC reporting complications and additional tax costs. For example, a U.S.-based fund investing in emerging markets may benefit from a 15% long-term capital gains rate, whereas a similar foreign-listed fund could incur a tax rate near 50%.

Foreign Pension Plans Often Cause PFIC Problems

Foreign pension plans, especially private pension plans, often include PFICs, especially if not qualified under a U.S. double tax treaty.

The underlying PFIC investments in such plans must be reported individually, making it burdensome for U.S. taxpayers. Avoiding voluntary contribution pension plans not covered by a tax treaty can help steer clear of PFIC-related issues when filing U.S. tax returns.

"Reverse PFICs" in Other Countries

Many countries have similar rules to the U.S. PFIC regime, such as the U.K.'s "reporting funds regime" and regulations in Germany, Austria, Australia, and New Zealand. These rules discourage owning non-transparent offshore funds.

These challenges do not ease if and when you obtain dual citizenship. For example, an American living in Germany who decides to apply for German citizenship would face the same (if not heightened) complications as a dual citizen that they faced as a legal resident.

Building Cross-Border Wealth in a Tax-Efficient Manner

Understanding PFIC rules is crucial for U.S. expats, green card holders, and other U.S. taxable persons. Due to the Foreign Account Tax Compliance Act (FATCA), it's increasingly important for U.S. taxpayers to report all foreign investments accurately.

Many foreign financial advisors may not realize the tax inefficiencies of selling foreign funds classified as PFICs to U.S. taxpayers. Therefore, U.S. citizens abroad should use U.S. investment funds and work with financial advisors specializing in cross-border matters.

Additionally, green card holders and foreign nationals should consider selling PFICs before moving to the U.S. for a cost-effective and tax-efficient way to build wealth globally. (4)

All This to Say

For American expats in Europe, understanding PFIC rules is key to avoiding unexpected tax burdens. Sticking to U.S.-registered funds and working with a cross-border financial planner can help ensure compliance while keeping your investment strategy on track. For tailored guidance, consult an advisor who specializes in U.S. expat tax planning.

References

- ISIN Organization

- About IRS Form 8621

- About IRS Form 5471

- Financial Advisor for Immigrants and Foreign Nationals to the U.S.

Additional resources:

The CFC/PFIC overlap rule after aggregate treatment

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.