In Germany, dual citizenship has historically been quite restrictive.

While the U.S. has allowed dual citizenship since 1967, until recently, many U.S. citizens seeking German citizenship had to consider renouncing their American nationality to obtain German citizenship.

Exceptions to this rule existed, depending on factors such as the applicant’s country of origin, birthplace, and residency status in Germany, but the process was challenging. (1)

Below, we break down some of the history here, as well as how to get dual citizenship in Germany.

The Legal Update on Dual Citizenship in Germany

German dual citizenship became more accessible when the Modernization of the Citizenship Law (StARModG) was adopted by the Bundestag in January 2024. It took effect on June 27, 2024. (2)

This development opens up new opportunities for U.S. citizens.

Below, we outline what dual citizenship is, factors unique to Americans considering applying for dual citizenship in Germany, and financial planning considerations to be aware of when residing in Germany as an American citizen.

What is Dual Citizenship?

Dual citizenship allows individuals to hold citizenship in two countries simultaneously, enjoying the rights, privileges, and responsibilities of both. Examples of these rights and privileges include the ability to vote in local and federal elections and access to financial institutions and accounts in both countries.*

Benefits of Germany Dual Citizenship for Americans

For U.S. citizens, holding dual citizenship can provide significant advantages, such as the ability to live and work freely in another country while maintaining American citizenship.

*Access to financial institutions and accounts in multiple countries is straightforward, particularly for Americans. If you have questions about how moving to Germany or living in Germany could affect your financial plan, please see if you qualify for a preliminary call.

Can U.S. Citizens Hold Dual Citizenship with Germany?

Yes, U.S. citizens can now hold dual citizenship with Germany under specific conditions.

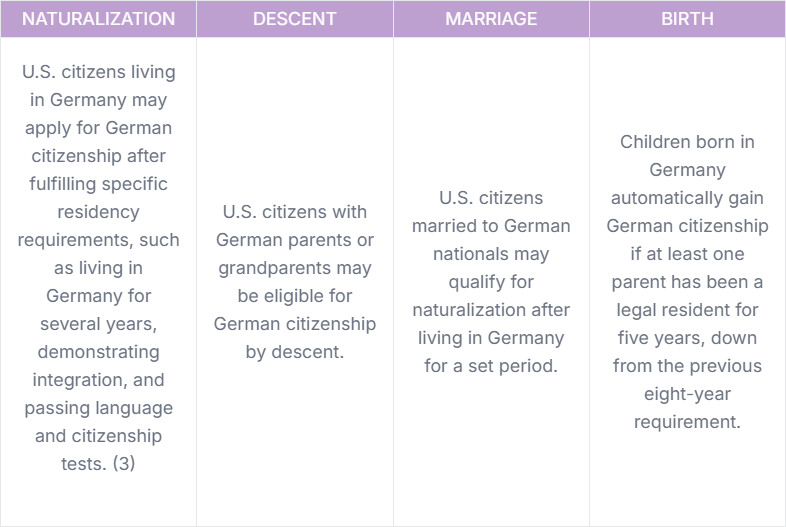

Historically, Germany’s laws made it difficult for non-EU nationals to retain their original citizenship when applying for German nationality. However, with the new legal changes, U.S. citizens can now obtain German citizenship without renouncing their U.S. citizenship through various pathways.

How to Get Dual Citizenship in Germany

This is excellent news because Germany is one of the most powerful passports in the world. German passport holders enjoy visa-free access to over 192 countries (even more than the U.S. passport, which allows for visa-free access to 186 countries).

Checklist: Applying for Dual Citizenship in Germany

The updated process to apply for dual citizenship includes completing the application form (provided by your nationality authority, Staatsangehörigkeitsbehörde).

Additionally, you must gather documentation to prove your:

- Identity (e.g., passport, birth certificate)

- Civil status (e.g., marriage certificate,

- Permanent right of residence (in some cases, a temporary residence permit may be sufficient)

- Current living situation (e.g., copy of your current lease)

- Residence in Germany first least five years

- Financial independence (e.g., employment contracts, income tax assessments)

- B1 German language certificate from an accepted test

- Proof of passing the naturalization test, which you can sign up for at a test center run by the Federal Office for Migration and Refugees (BAMF).

You must also provide proof of paying the application fee (255€ per adult, 51€ per minor child) (4) and submit your application materials in person at the same office that provided your application form.

The typical waiting period to hear back after submitting your application for German citizenship is between 18-24 months.

Once you become a German citizen, you’ll receive a certificate of nationality, which you can use to apply for a German passport.

From that point, you’ll have all the same rights, protections, and obligations as all other German nationals.

This section was completed with substantial reference to einbürgerung.de, (5,6)

Closing Thoughts on Dual Citizenship in Germany

While dual citizenship in Germany has recently become more accessible for qualifying Americans, it’s important to understand that obtaining German citizenship and residing in Germany do not end your U.S. tax obligations.

Additionally, holding U.S. citizenship can make building wealth more challenging for Americans living in Germany. Investment strategies that would typically benefit German residents may trigger PFIC filing requirements in the U.S. The only way to end your U.S. tax filing obligations is to renounce U.S. citizenship.

Dual Citizenship U.S. and Germany - FAQ

How many Americans live in Germany?

There are an estimated 120,000 Americans living in Germany.

Do I need to report my German bank accounts to the IRS?

Yes, if you have more than $10,000 USD combined at any point in the year in non-U.S. accounts, including Germany, you will need to file an FBAR with the U.S. Treasury. This requirement does not change when you become a dual German citizen.

Why Does the U.S. Have Military Bases in Germany?

The U.S. military presence in Germany today is a result of the Convention on the Presence of Foreign Forces in the Federal Republic of Germany, signed in 1954 by West Germany. It allowed eight NATO members, including the U.S., to have a permanent military presence in Germany. (9) Today, the U.S. also benefits from the strategic geopolitical positioning afforded by having troops stationed in the largest EU country, which also lies at the gateway to Central Europe and beyond.

References

- Obligation to choose one citizenship

- Retention Permit to keep German citizenship when naturalizing in the US / “Dual citizenship”

- Germany sees highest number of naturalisations in 23 years

- What's the Estate Tax Exemption For 2024? | Kiplinger

- Germany - Individual - Other taxes (PwC)

- Qualified Personal Residence Trust (QPRT): Overview and Examples

- Gift Tax Thresholds

- Topic no. 701, Sale of your home

- U.S. Military in Germany: What You Need to Know

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.