It’s the end of the year, which means “Roth conversion” is a topic many are discussing with their financial planners (if they have not done so already).

While Roth conversions can be excellent financial planning tools when used correctly, there are some nuanced considerations U.S. expats need to keep in mind.

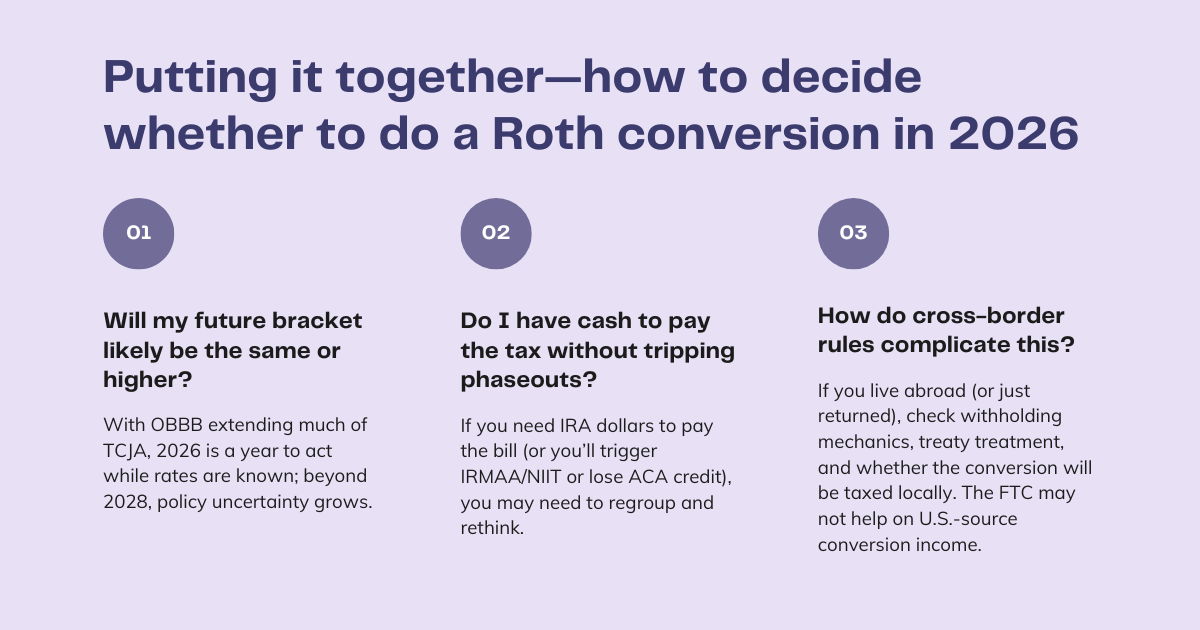

Zooming out, with recent changes keeping many TCJA-era brackets in place (for now), 2026 can be a smart year to “fill your bracket” while rates are known. If your life has cross-border layers, this decision sits alongside visa timing, state domicile, and treaty rules, which is why we frame it through a cross-border lens.

If you’re also planning a move home, read this in tandem with our companion piece, Moving Back: A U.S. Repatriation Guide, and our overview of Foreign Earned Income Exclusion vs. Foreign Tax Credit to understand how conversions interact with your overall tax picture.

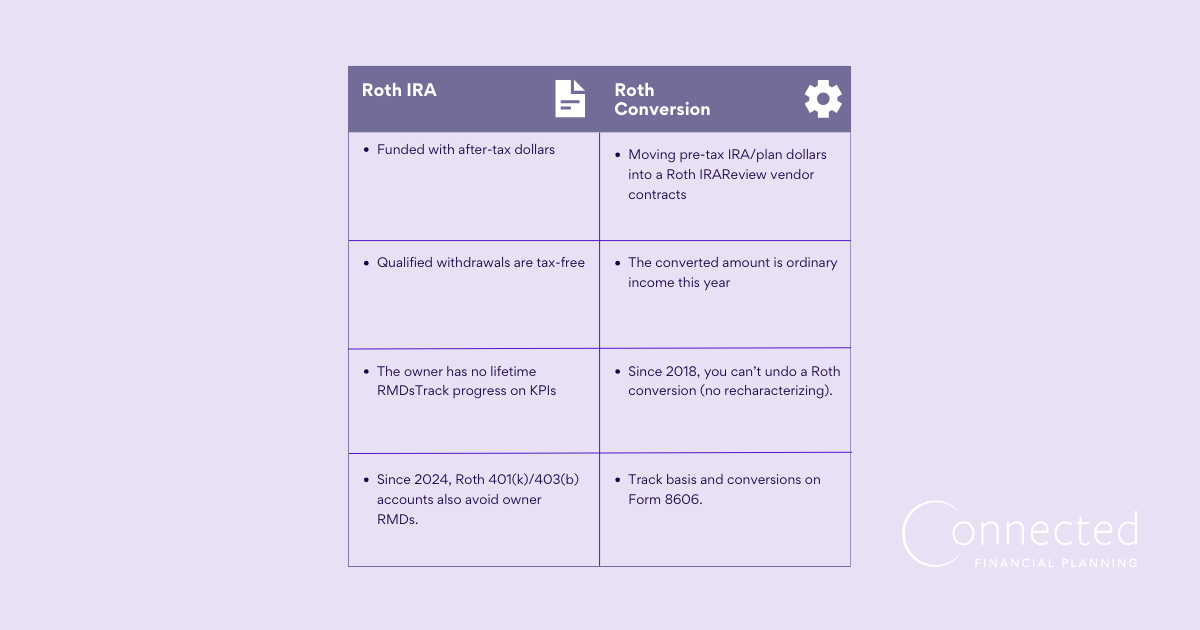

Roth IRA and Roth conversion—quick refresh

A Roth IRA is funded with after-tax dollars, and qualified withdrawals are tax-free.

You also avoid lifetime RMDs on Roth IRAs; since 2024, designated Roth accounts in employer plans are treated similarly for owners.

If you’re evaluating a conversion, remember that moving pre-tax dollars to Roth creates ordinary income this year, and you’ll track the taxable vs. nontaxable portion on IRS Form 8606.

If you’re considering a Roth conversion alongside generally thinking about end-of-year tax planning, add this to your reading queue: End-of-Year Tax Planning for U.S. Expats.

Why 2026 is a real window

OBBB effectively preserved the TCJA’s lower individual brackets for now. That keeps today’s rate table intact and makes 2026 a prime year to target a conversion amount that fills your current bracket, as opposed to potentially paying at higher future rates if Congress changes course.

How a conversion is taxed (and how much)

- Bracket stacking. The conversion adds to AGI and taxable income on top of wages, interest, etc.

- Pro-rata rule. If you have both pre-tax and after-tax (basis) dollars across all your traditional IRAs, any partial conversion is taxed pro-rata. Form 8606 calculates the taxable vs. nontaxable share. (A common tactic is moving pre-tax IRA money into an employer plan first, if allowed, to “isolate basis” before converting.)

- Pay the tax in cash. Using outside dollars to cover the bill keeps the entire converted amount compounding tax-free.

- No recharacterization. Model before you execute—there’s no mulligan since 2018.

Keep in mind RMD coordination. If you’re already subject to RMDs, you must take the RMD first; RMD amounts themselves can’t be converted.

When a Roth conversion can shine

- Low-income or “gap” year. Career change, sabbatical, business dip, or a mid-year move can create room in lower brackets. Consider here that a move to Europe from the U.S. could facilitate a strategically low-income year.

- Market pullbacks. Converting depressed assets means more future recovery inside the Roth.

- Pre-RMD years. Converting in your 60s can shrink future taxable RMDs from traditional accounts and smooth lifetime taxes.

- State-tax strategy. Convert while living in a no/low-tax state before a move to a higher-tax state or jurisdiction.

- Estate/legacy. Heirs generally receive income-tax-free distributions from inherited Roth IRAs, and you avoid owner RMDs during life (Roth IRA; designated Roth accounts too from 2024).

Key factors when considering a Roth conversion

- Phaseouts and cliffs. Conversions can trigger IRMAA Medicare surcharges two years later, the 3.8% Net Investment Income Tax (NIIT), and affect Affordable Care Act (ACA) premium credits, education credits, and QBI.

- Cash to pay the tax. Paying tax from the IRA reduces what reaches the Roth and may cause penalties if you’re under 59½.

- Financial aid years. Big income spikes can reduce need-based aid.

- State taxes. Watch part-year moves and sourcing rules.

- No undo button. Once you convert, you live with the result. (Running a simulation is crucial so you can understand what the projected long-term effect looks like.)

Modeling simulations

- As mentioned, run a projection. Map income to date, estimate year-end bonuses, harvest gains/losses, and choose a conversion amount that fills your target bracket without tripping IRMAA/NIIT/credit cliffs.

- Tranches vs. lump sum. Some investors stage conversions (e.g., monthly/quarterly) to average market entry.

- Withholding & estimates. Meet safe harbors to avoid penalties; document the conversion (you’ll see 1099-R, 5498, and Form 8606 at tax time).

- RMDs first (if applicable). RMD dollars cannot be converted.

Special notes for Americans abroad (or newly repatriated)

Custodian withholding to foreign addresses

Many providers withhold by default on IRA distributions delivered outside the U.S. Some treat it as required when funds are paid abroad; policies vary, and the IRS generally requires withholding on plan payments to foreign payees absent proper U.S. documentation. If withholding applies, “top up” so the intended gross amount reaches the Roth. Check your custodian and treaty status before you act, ideally in partnership with a cross-border financial planner.

Local taxation & treaty recognition

Most countries, including Germany and Switzerland, don’t recognize Roth IRAs as tax-exempt; conversions or withdrawals may be taxed locally, and in some places, Roth balances can factor into wealth-tax calculations.

Foreign Tax Credit realities

The FTC generally offsets U.S. tax only on foreign-source income. A U.S. IRA conversion is commonly treated as U.S.-source, so foreign credits may not help. (Treaty “re-sourcing” is narrow and situation-dependent.) Coordinate with a cross-border tax adviser.

Residency timing

In a dual-status year (returning to the U.S.), the date you re-establish residency affects how the conversion shows up on your return and whether foreign filing or exit rules still apply.

FAQs

What are the Roth conversion rules in 2026?

A conversion adds ordinary income in 2026; you can’t recharacterize it later, and if you have basis in any IRA, the pro-rata calculation applies on Form 8606.

Does a Roth conversion count as my RMD?

No. If you’re subject to RMDs, you must withdraw the RMD first; that RMD amount cannot be converted.

Roth IRA vs. Roth 401(k) on RMDs—what changed?

Starting in 2024, owner RMDs no longer apply to designated Roth accounts (e.g., Roth 401(k)/403(b)), aligning them with Roth IRAs. Beneficiaries are still subject to post-death RMD rules.

What about a Roth conversion ladder?

Spreading conversions over several years can keep you under key thresholds (IRMAA, NIIT, credit cliffs) while steadily building tax-free assets. It’s a math exercise: model the bracket fill each year, and keep an eye on when key provisions of the TCJA are due to expire again.

401(k) to Roth IRA conversion—anything special?

Rollovers from a traditional 401(k) to a Roth IRA are taxable the same way (ordinary income). Be sure to handle any pre-tax and after-tax allocations correctly and keep your paperwork.

If you expect your marginal tax rate in 2026 or later to be the same as—or higher than—your 2025 rate, and you have cash on hand to pay the conversion tax without tripping income-related surcharges (like Medicare IRMAA), the 3.8% Net Investment Income Tax, or losing ACA premium credits, then doing a targeted Roth conversion in 2026 is often sensible.

In conclusion

When done correctly, a Roth conversion can move more of your lifetime growth into a tax-free bucket. But it’s important to make sure the math supports it, and cross-border situations require particularly diligent reviews of local laws so that you’re not inadvertently raising your overall tax bill by overemphasizing the savings on the U.S. side.

With OBBB keeping today’s brackets in place (for now), 2026 offers a clean window to act.

If your life has cross-border layers or you’re simply unsure where to start, connect with a cross-border-aware financial planner to run a precise projection and coordinate the tax work so your conversion fits your bigger plan.

References

- IRS: Owner RMDs don’t apply to designated Roth accounts starting 2024; RMD FAQs.

- IRS: Form 8606 instructions (pro-rata; no recharacterizing conversions after 2017).

- IRS: Withholding on plan distributions to foreign persons; example custodian language on payments outside the U.S.

- Policy context on OBBB extensions of TCJA provisions.

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.