Moving to Germany from the U.S. brings many exciting opportunities, but navigating the country's healthcare system can be complex.

Germany boasts a universal multi-payer healthcare system, ensuring that all residents have access to medical services.

This guide aims to provide U.S. expats with a comprehensive overview of how health insurance works in Germany, helping you make informed decisions about your healthcare coverage, whether you’re an employee, self-employed, parent, or international student.

Mandatory Health Insurance in Germany

Since 2009, it has been mandatory for all residents in Germany, including expats, to have health insurance. This requirement ensures that everyone contributes to and benefits from the healthcare system.

There are two primary types of health insurance in Germany: statutory (public) and private.

Statutory Health Insurance in Germany (Gesetzliche Krankenversicherung - GKV)

Statutory health insurance is the most common form of coverage in Germany, covering approximately 90% of the population. It is a non-profit system regulated by the government but administered by independent public health insurance providers.

Key features include:

Eligibility

Mandatory for employees earning less than €73,800 annually (as of 2025). Expats working in Germany with an employment contract are typically enrolled automatically. Almost everyone is eligible to take out public insurance.

The Price of Health Insurance in Germany

Public health insurance contributions in Germany are approximately 17.05% of your gross salary in 2025, split equally between you and your employer. This includes a general contribution rate of 14.6% and an average supplementary premium of around 2.5%, which may vary slightly depending on the health insurance provider.

For employees earning over €66,150, monthly premiums can reach up to €602.

Self-employed individuals may pay up to €1,174 per month, depending on income and coverage level.

Coverage

Public health insurance covers comprehensive care, including:

- doctor visits

- specialist consultations

- hospital stays in shared rooms

- prescription medications

- preventive services

- maternity care

- mental health support, and

- some dental services.

Medical providers bill the public insurance directly, meaning the insured person usually does not pay upfront for necessary medical treatment.

Family Coverage

Non-working dependents (spouse and children) are covered at no additional cost under your policy.

Ease of Access

Policyholders have the freedom to choose their own doctors and can typically visit specialists with a referral.

GKV is particularly beneficial for families, individuals with pre-existing conditions, and those who value predictable monthly premiums and extensive benefits.

Tip: If you are going for medical treatment as a publicly insured person, always confirm with the provider that they accept public insurance.

Germany Health Insurance for International Students

Students (under the age of 30) are also eligible for public health insurance.

Contributions depend on age and whether you have children. Proof of adequate health insurance is required for student visa approval, and the coverage may come from either public or private providers, depending on individual circumstances.

Popular public health insurance providers include TK (Techniker Krankenkasse), Barmer, AOK, and DAK.

While many offer services and websites in English, not all insurance companies provide information in English. If this is important to you, be sure to check for English-language support before selecting a policy. This can be especially helpful for U.S. expats navigating the system for the first time.

Does Germany Have Private Health Insurance?

Yes. Opting for private health insurance in Germany can offer benefits beyond what's typically covered by public insurance, such as more flexible doctor appointments, faster access to treatments, and coverage for specific services not covered by statutory insurance.

Private Health Insurance (Private Krankenversicherung - PKV)

Private health insurance (PKV) in Germany is a popular option for certain groups of residents. Unlike public insurance, private insurance is profit-based, and premiums are calculated based on individual risk factors (similar to those in the U.S.).

Key features include:

Eligibility

PKV is available to employees earning more than €73,800 annually (as of 2025), self-employed individuals and freelancers (typically with an income of at least €30,000), students, and civil servants. Employees below the threshold are not eligible unless they were previously in the private system.

Premiums

Premiums are risk-based and determined by age, health condition, and chosen benefits, not income. This can make PKV especially appealing for young, healthy individuals who may pay less than they would under GKV. However, premiums often increase with age and may rise significantly over time.

Coverage

PKV policies can be tailored to include high-end benefits such as:

- Shorter wait times for appointments

- Access to private hospital rooms and top-tier specialists

- Expanded dental and vision care

- Full reimbursement for medication, therapies, and alternative treatments

Billing Process

Unlike GKV, private patients typically pay for services upfront and then submit receipts to their insurer for reimbursement. This requires more administrative effort, but many providers offer digital tools to simplify the claims process.

Family Coverage

Each family member must be insured separately; there is no automatic dependent coverage like in the public system. This can make PKV more expensive for families.

Portability and Language

Many PKV companies offer plans tailored to expats, with documentation and customer service available in English. Ottonova is a popular choice among international residents for its English-speaking support and digital-first approach.

PKV can be an attractive option for those who value higher-quality care and shorter wait times. However, it's crucial to evaluate long-term affordability and the flexibility of the plan.

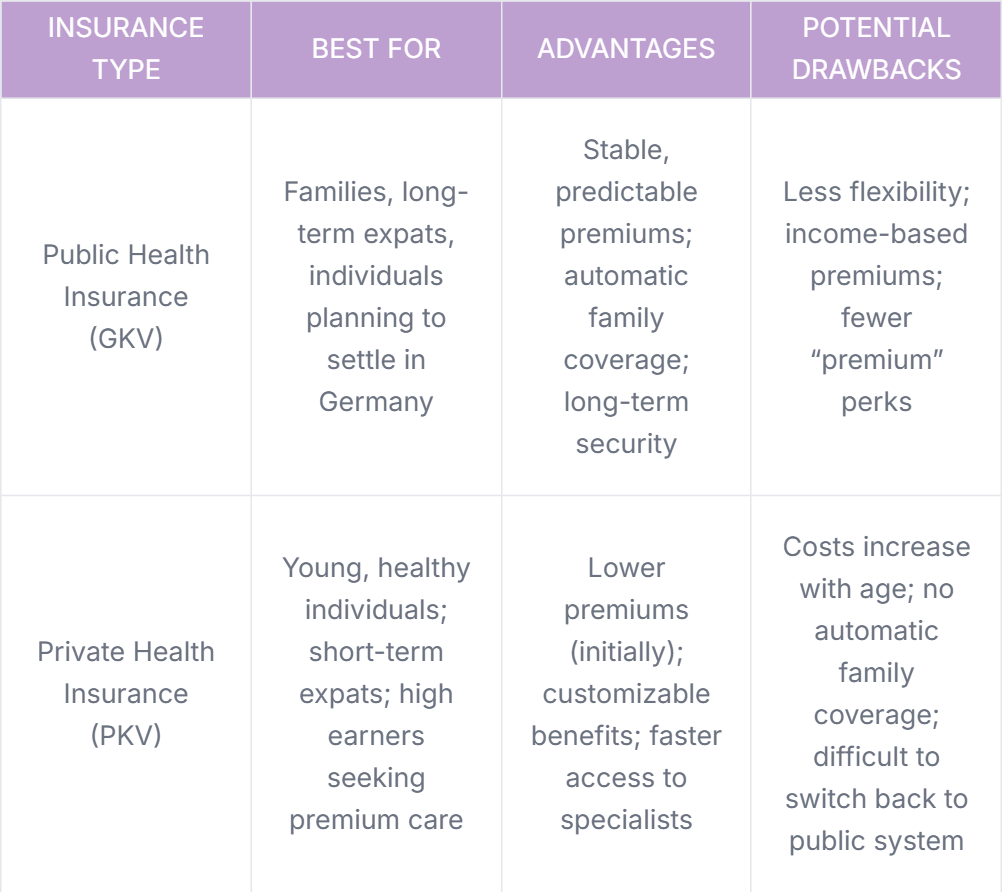

Private VS Public Health Insurance in Germany

Switching back to GKV from PKV is generally not allowed after age 55, and even before then, it can be administratively difficult unless specific qualifying conditions are met (such as becoming an employee below the income threshold).

Before enrolling, carefully assess your health, age, family situation, and future plans in Germany.

If there's any chance you might remain in Germany long-term, it's wise to understand the potential consequences of locking into a private health insurance plan.

Expat Health Insurance

For newcomers awaiting employment or those not yet eligible for public or private insurance, expat health insurance offers temporary coverage. This type of insurance is particularly useful for:

- Visa Applicants: As mentioned earlier, visa applicants must provide proof of insurance for residency permits.

- Job Seekers: Ensuring Coverage During the Job Search Period

Expat insurance policies are designed to meet the minimum coverage requirements set by German immigration authorities.

Providers like Feather offer flexible plans that can later be transitioned into statutory or private coverage once you become eligible.

Expatriate Health Insurance in Germany: Additional Options

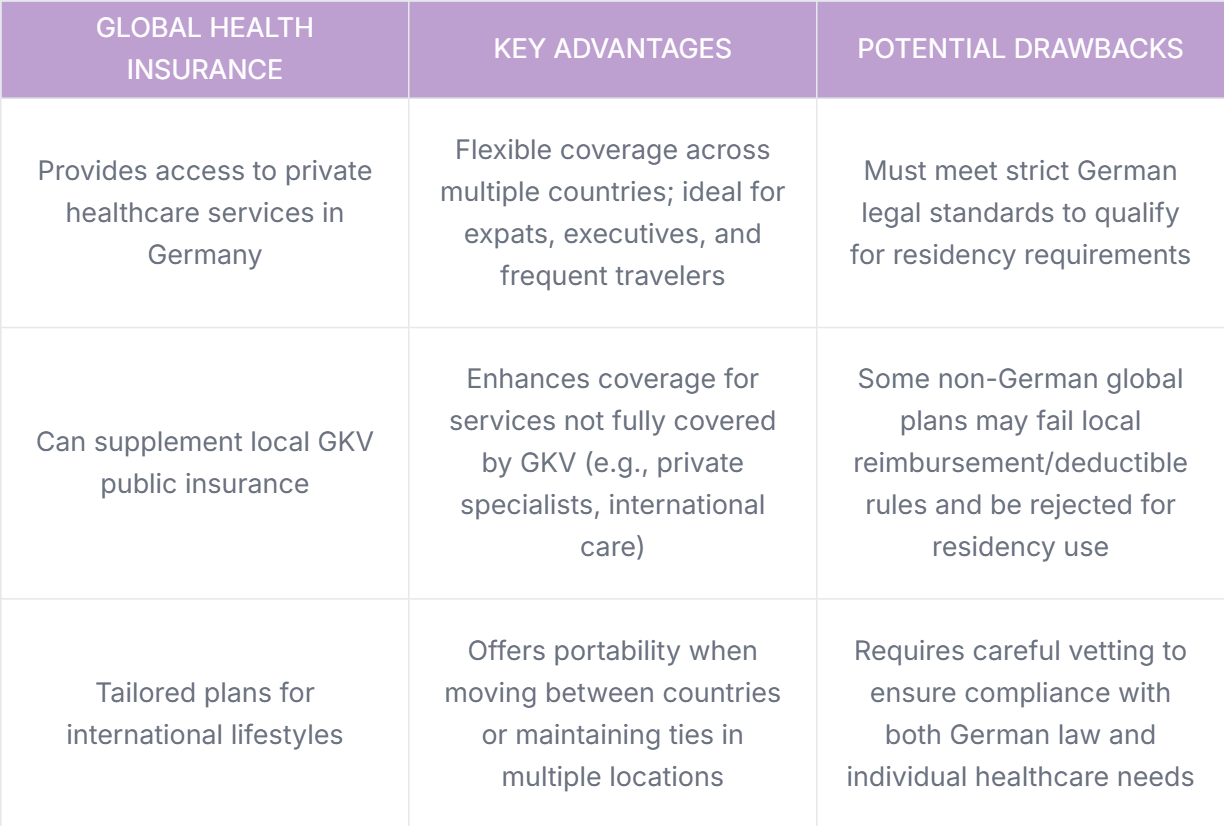

Consider: Global health insurance from international private insurers.

These plans can offer comprehensive medical coverage in Germany as well as worldwide, including your home country, which makes them a strong option for executives, frequent travelers, or digital nomads.

Before committing to an expat or global insurance plan, speak with a licensed advisor to ensure your policy meets all legal requirements and aligns with your short- and long-term needs in Germany.

Having a Baby in Germany: Costs and Coverage for U.S. Expats

Germany offers comprehensive maternity and childbirth care through both its public and private health systems. For U.S. expats, understanding how coverage and costs work during pregnancy, birth, and postnatal care can ease the transition and support better planning.

Additional Considerations for U.S. Expats

Health Insurance in Germany for Freelancers

Freelancers moving to Germany may face challenges enrolling in the public health insurance system, especially if they are newly self-employed and do not have a prior history in the German insurance system.

In such cases, private insurance or expat insurance may serve as an initial solution until public options become available.

Long-Term Care Insurance (Pflegeversicherung)

Mandatory and typically bundled with health insurance, covering support for individuals requiring long-term care.

Assessment and Care Levels

Upon application, the Medical Service of the Health Insurance Funds (MDK) conducts an assessment to determine the level of care required, categorized into five grades (Pflegegrade):

- Grade 1: Minor impairments.

- Grade 2: Significant impairments.

- Grade 3: Severe impairments.

- Grade 4: Most severe impairments.

- Grade 5: Most severe impairments with special requirements for nursing care.

The assessment evaluates mobility, cognitive and communicative abilities, behavior, self-care, management of health-related demands, and daily life organization.

Benefits

Benefits are designed to support various care needs:

- Home Care (Ambulante Pflege): Financial support for in-home care services or allowances for family members providing care.

- Inpatient Care (Vollstationäre Pflege): Coverage for nursing home expenses, with benefits increasing according to the care grade.

- Partial Inpatient Care (Teilstationäre Pflege): Support for day or night care services in specialized facilities.

- Short-Term and Respite Care: Temporary relief for caregivers or transitional care after hospitalization.

- Home Modifications: Subsidies for adapting living spaces to accommodate care needs.

Benefit amounts vary based on the care grade and type of service, ensuring tailored support for each individual's situation. Given that statutory benefits may not cover all expenses, individuals can opt for supplementary private long-term care insurance. This may be especially important for expats who may age away from immediate family member support.

Dental and Vision Coverage

Basic services are included in statutory insurance, but supplemental private policies can enhance coverage.

Under Germany's statutory health insurance (Gesetzliche Krankenversicherung - GKV), basic dental services are covered, including:

- Routine check-ups

- Simple fillings

- Tooth extractions

- Basic periodontal treatments

Beyond Basic Coverage

For more complex procedures like crowns, bridges, dentures, and implants, GKV typically covers only a portion of the costs.

The standard coverage rate is around 60%, which can increase to 65% after five years and 70% after ten years of regular dental check-ups.

Prescription Costs

Germany employs a co-payment system to share medication costs between patients and health insurance providers.

For those enrolled in Germany's statutory health insurance (Gesetzliche Krankenversicherung - GKV), the majority of prescription medication costs are covered by the insurance. However, patients are responsible for a co-payment, known as "Zuzahlung," which is calculated as follows:

Standard Co-Payment

10% of the medication's price per package.

Minimum Co-Payment

€5 per package.

Maximum Co-Payment

€10 per package.

Low-Cost Medications

If the medication costs less than €5, the patient pays the full price.

These co-payments are paid directly at the pharmacy when collecting the medication. The coverage and process may vary depending on your private insurance coverage.

Exemptions and Reductions

Certain groups are exempt from co-payments:

- Children and Adolescents: Individuals under 18 years old are exempt from co-payments.

- Pregnancy and Maternity: Medications related to pregnancy and childbirth are exempt.

- Low-Income Individuals: Patients whose annual co-payments exceed 2% of their gross annual income (or 1% for those with chronic illnesses) can apply for an exemption from further co-payments for the remainder of the year

Reference Pricing and Generic Substitution

Germany utilizes a reference pricing system to control medication costs.

If a prescribed medication exceeds the reference price for its category, patients may be required to pay the difference in addition to the standard co-payment.

Pharmacies may substitute prescribed medications with equivalent generics unless the prescribing doctor indicates "aut idem" (no substitution) on the prescription. This practice ensures cost-effective dispensing of medications.

Tips for Choosing a Provider

Research and compare providers to find one that offers services in English and meets your specific healthcare needs.

Not all health insurance providers—statutory or private—offer English-language support.

Tip: Providers such as TK (public) and Ottonova (private) are known for their expat-friendly services in English.

Final Thoughts

Understanding Germany's health insurance system is crucial for a smooth transition as a U.S. expat.

Assess your employment status, income level, and personal healthcare needs to determine the most suitable insurance option. Whether opting for statutory, private, or expat health insurance, ensuring continuous coverage is essential for your well-being while living in Germany.

Resources

- Information about the German health insurance system | TK

- Feather Expat Insurance

- Germany Dental Health Insurance | I Am Expat

- Medication Costs - Insurance Cover and Co-Payments

- Pregnancy and Giving Birth in Germany | Expatica

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.